BRAINLIEST ANSWER+50 POINTS

Plz do all

Russ and Sandy are a young 30 something couple w...

Business, 10.12.2020 07:50 acavalieri72

BRAINLIEST ANSWER+50 POINTS

Plz do all

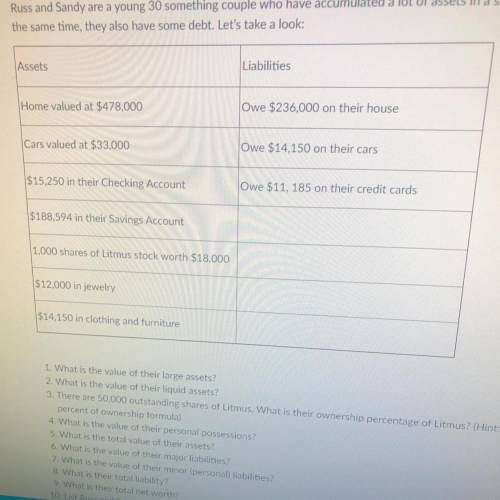

Russ and Sandy are a young 30 something couple who have accumulated a lot of assets in a short amount of time. At

the same time, they also have some debt. Let's take a look:

Assets

Liabilities

Home valued at $478,000

1. What is the value of their large assets?

2. What is the value of their liquid assets?

3. There are 50,000 outstanding shares of litmus. What is their ownership percentage of Litmus? (Hint; Use the percent of ownership formula)

4. What is the value of their personal possessions

5. What is the total value of their assets?

6.What is the value of their major liabilities?

7. What is the value of their minor (personal) liabilities?

8. What is their total liability?

9. What is their total net worth?

10. List Russ and Sandy’s liquid assets.

Answers: 3

Another question on Business

Business, 22.06.2019 21:10

You are the manager of a large crude-oil refinery. as part of the refining process, a certain heat exchanger (operated at high temperatures and with abrasive material flowing through it) must be replaced every year. the replacement and downtime cost in the first year is $165 comma 000. this cost is expected to increase due to inflation at a rate of 7% per year for six years (i.e. until the eoy 7), at which time this particular heat exchanger will no longer be needed. if the company's cost of capital is 15% per year, how much could you afford to spend for a higher quality heat exchanger so that these annual replacement and downtime costs could be eliminated?

Answers: 1

Business, 23.06.2019 15:00

Alamar petroleum company offers its employees the option of contributing retirement funds up to 5% of their wages or salaries, with the contribution being matched by alamar. the company also pays 80% of medical and life insurance premiums. deductions relating to these plans and other payroll information for the first biweekly payroll period of february are listed as follows: wages and salaries $ 2,800,000 employee contribution to voluntary retirement plan 92,000 medical insurance premiums 50,000 life insurance premiums 9,800 federal income taxes to be withheld 480,000 local income taxes to be withheld 61,000 payroll taxes: federal unemployment tax rate 0.60 % state unemployment tax rate (after futa deduction) 5.40 % social security tax rate 6.20 % medicare tax rate 1.45 % required: prepare the appropriate journal entries to record salaries and wages expense and payroll tax expense for the biweekly pay period. assume that no employee's cumulative wages exceed the relevant wage bases for social security, and that all employees' cumulative wages do exceed the relevant unemployment wage bases.

Answers: 3

Business, 23.06.2019 17:00

Suppose that a recent celebrity endorsement made more people prefer this brand of cell phones. now, more cell phones are demanded at each price level. as a result of the increase in demand, the equilibrium price and the equilibrium quantity increases, decreases

Answers: 1

Business, 23.06.2019 19:10

About 300 billion dollars in taxes is lost in the united states alone due to an underground economy, which involves paying individuals cash rather than having them on the official payroll

Answers: 1

You know the right answer?

Questions

Mathematics, 26.11.2021 19:00

Chemistry, 26.11.2021 19:00

Mathematics, 26.11.2021 19:00

Social Studies, 26.11.2021 19:00

Social Studies, 26.11.2021 19:00

Mathematics, 26.11.2021 19:00

Spanish, 26.11.2021 19:00