Answers: 2

Another question on Business

Business, 22.06.2019 18:00

Which of the following is a characteristic that can be used to guide the design of service systems? a. services cannot be inventoried. b. services are all similar. c. quality work means quality service. d. services businesses are inherently entrepreneurial. e. even service businesses have internal services.

Answers: 2

Business, 22.06.2019 23:30

As a result of a thorough physical inventory, waterway company determined that it had inventory worth $320200 at december 31, 2020. this count did not take into consideration the following facts: walker consignment currently has goods worth $47400 on its sales floor that belong to waterway but are being sold on consignment by walker. the selling price of these goods is $75900. waterway purchased $21900 of goods that were shipped on december 27, fob destination, that will be received by waterway on january 3. determine the correct amount of inventory that waterway should report.

Answers: 2

Business, 23.06.2019 02:30

Zendor company wants to have $200,000 available in august 2021 to make an equipment purchase. to be able to have this amount available, zendor will make equal annual deposits in an investment account earning 12% annually in june 2017, 2018, 2019, 2020, and 2021. what is the dollar amount that must be deposited each of those years to achieve this objective?

Answers: 3

You know the right answer?

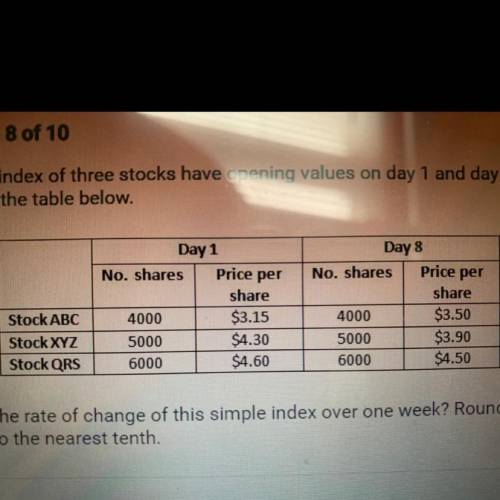

A simple index of three stocks have opening values on day 1 and day 8 as shown in the table below. W...

Questions

History, 02.07.2019 08:30

Health, 02.07.2019 08:30

Mathematics, 02.07.2019 08:30

Social Studies, 02.07.2019 08:30

Biology, 02.07.2019 08:40