Business, 15.11.2020 01:30 chicalapingpon1938

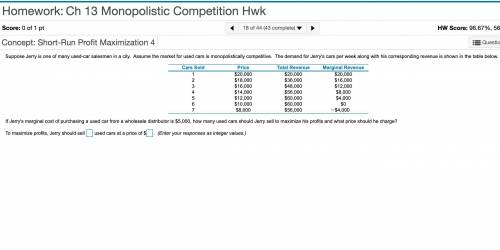

Suppose Jerry is one of many used-car salesmen in a city. Assume the market for used cars is monopolistically competitive. The demand for Jerry's cars per week along with his corresponding revenue is shown in the table below. Cars Sold Price Total Revenue Marginal Revenue 1 $20,000 $20,000 $20,000 2 $18,000 $36,000 $16,000 3 $16,000 $48,000 $12,000 4 $14,000 $56,000 $8,000 5 $12,000 $60,000 $4,000 6 $10,000 $60,000 $0 7 $8,000 $56,000 $4,000 If Jerry's marginal cost of purchasing a used car from a wholesale distributor is $, how many used cars should Jerry sell to maximize his profits and what price should he charge? To maximize profits, Jerry should sell nothing used cars at a price of $ nothing. (Enter your responses as integer values.)

Answers: 3

Another question on Business

Business, 22.06.2019 12:50

Kendrick is leaving his current position at a company, and charlize is taking over. kendrick set up his powerpoint for easy access for himself. charlize needs to work in the program that is easy for her to use. charlize should reset advanced options

Answers: 3

Business, 22.06.2019 14:50

Pederson company reported the following: manufacturing costs $480,000 units manufactured 8,000 units sold 7,500 units sold for $90 per unit beginning inventory 2,000 units what is the average manufacturing cost per unit? (round the answer to the nearest dollar.)

Answers: 3

Business, 23.06.2019 02:40

Exercise 6-2 variable costing income statement; explanation of difference in net operating income [lo6-2] ida sidha karya company is a family-owned company located on the island of bali in indonesia. the company produces a handcrafted balinese musical instrument called a gamelan that is similar to a xylophone. the gamelans are sold for $970. selected data for the company’s operations last year follow: units in beginning inventory 0 units produced 200 units sold 180 units in ending inventory 20 variable costs per unit: direct materials $ 130 direct labor $ 300 variable manufacturing overhead $ 30 variable selling and administrative $ 15 fixed costs: fixed manufacturing overhead $ 63,000 fixed selling and administrative $ 25,000 the absorption costing income statement prepared by the company’s accountant for last year appears below: sales $ 174,600 cost of goods sold 139,500 gross margin 35,100 selling and administrative expense 27,700 net operating income $ 7,400 required: 1. under absorption costing, how much fixed manufacturing overhead cost is included in the company's inventory at the end of last year? 2. prepare an income statement for last year using variable costing.

Answers: 2

Business, 23.06.2019 10:10

Type the correct answer in the box. spell all words correctly. what could be the cause for robert’s symptoms? every time a project deadline approached, robert became agitated, angry, and suffered from frequent headaches. his manager concluded that he was suffering from .

Answers: 3

You know the right answer?

Suppose Jerry is one of many used-car salesmen in a city. Assume the market for used cars is monopol...

Questions

History, 30.08.2019 08:00

Chemistry, 30.08.2019 08:00

Biology, 30.08.2019 08:00

Advanced Placement (AP), 30.08.2019 08:10

Mathematics, 30.08.2019 08:10

Chemistry, 30.08.2019 08:10

Mathematics, 30.08.2019 08:10

Mathematics, 30.08.2019 08:10

Mathematics, 30.08.2019 08:10

Mathematics, 30.08.2019 08:10

Chemistry, 30.08.2019 08:10

History, 30.08.2019 08:10

English, 30.08.2019 08:10