Business, 12.11.2020 18:50 violetagamez2

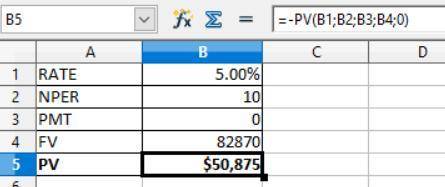

Steve Smith will receive $82,870 on 5 years from now, from a trust fund established by his father. Assuming the appropriate interest rate for discounting is 10% (compounded semiannually), what is the present value of this amount today? (Round factor values to 5 decimal places, e. g. 1.25124. Round answers to the nearest whole dollar, e. g. 5,275.)

Answers: 1

Another question on Business

Business, 21.06.2019 21:30

Ryan terlecki organized a new internet company, capuniverse, inc. the company specializes in baseball-type caps with logos printed on them. ryan, who is never without a cap, believes that his target market is college and high school students. you have been hired to record the transactions occurring in the first two weeks of operations. issued 2,900 shares of $0.01 par value common stock to investors for cash at $29 per share. borrowed $68,000 from the bank to provide additional funding to begin operations; the note is due in two years. paid $1,000 for the current month's rent of a warehouse and another $1,000 for next month's rent. paid $1,440 for a one-year fire insurance policy on the warehouse (recorded as a prepaid expense). purchased furniture and fixtures for the warehouse for $16,000, paying $3,200 cash and the rest on account. the amount is due within 30 days. purchased for $2,800 cash the university of pennsylvania, notre dame, the university of texas at austin, and michigan state university baseball caps as inventory to sell online. placed advertisements on google for a total of $340 cash. sold caps totaling $1,900, half of which was charged on account. the cost of the caps sold was $1,100. (hint: make two entries.) made full payment for the furniture and fixtures purchased on account in (e). received $280 from a customer on account.

Answers: 2

Business, 22.06.2019 06:10

Information on gerken power co., is shown below. assume the company’s tax rate is 40 percent. debt: 9,400 8.4 percent coupon bonds outstanding, $1,000 par value, 21 years to maturity, selling for 100.5 percent of par; the bonds make semiannual payments. common stock: 219,000 shares outstanding, selling for $83.90 per share; beta is 1.24. preferred stock: 12,900 shares of 5.95 percent preferred stock outstanding, currently selling for $97.10 per share. market: 7.2 percent market risk premium and 5 percent risk-free rate. required: calculate the company's wacc. (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) wacc %

Answers: 2

Business, 22.06.2019 21:00

Which of the following statements is correct? stockholders should generally be happier than bondholders to have managers invest in risky projects with high potential returns as opposed to safe projects with lower expected returns. potential conflicts between stockholders and bondholders are increased if a firm's bonds are convertible into its common stock. takeovers are most likely to be attempted if the target firm’s stock price is above its intrinsic value. one advantage of operating a business as a corporation is that stockholders can deduct their pro rata share of the taxes the firm pays, thereby eliminating the double taxation investors would face in a partnership.

Answers: 1

Business, 22.06.2019 23:50

For each of the following situations, indicate whether you agree or disagree with the financial reporting practice employed and state the basic assumption, component, or accounting principle that is applied (if you agree) or violated (if you disagree).wagner corporation adjusted the valuation of all assets and liabilities to reflect changes in the purchasing power of the dollar.spooner oil company changed its method of accounting for oil and gas exploration costs from successful efforts to full cost. no mention of the change was included in the financial statements. the change had a material effect on spooner's financial statements.cypress manufacturing company purchased machinery having a five-year life. the cost of the machinery is being expensed over the life of the machinery.rudeen corporation purchased equipment for $180,000 at a liquidation sale of a competitor. because the equipment was worth $230,000, rudeen valued the equipment in its subsequent balance sheet at $230,000.davis bicycle company received a large order for the sale of 1,000 bicycles at $100 each. the customer paid davis the entire amount of $100,000 on march 15. however, davis did not record any revenue until april 17, the date the bicycles were delivered to the customer.gigantic corporation purchased two small calculators at a cost of $32.00. the cost of the calculators was expensed even though they had a three-year estimated useful life.esquire company provides financial statements to external users every three years.

Answers: 1

You know the right answer?

Steve Smith will receive $82,870 on 5 years from now, from a trust fund established by his father. A...

Questions

Chemistry, 13.11.2019 19:31

English, 13.11.2019 19:31

History, 13.11.2019 19:31

English, 13.11.2019 19:31

Chemistry, 13.11.2019 19:31

English, 13.11.2019 19:31

English, 13.11.2019 19:31

Mathematics, 13.11.2019 19:31

History, 13.11.2019 19:31