Po

Additional Activities

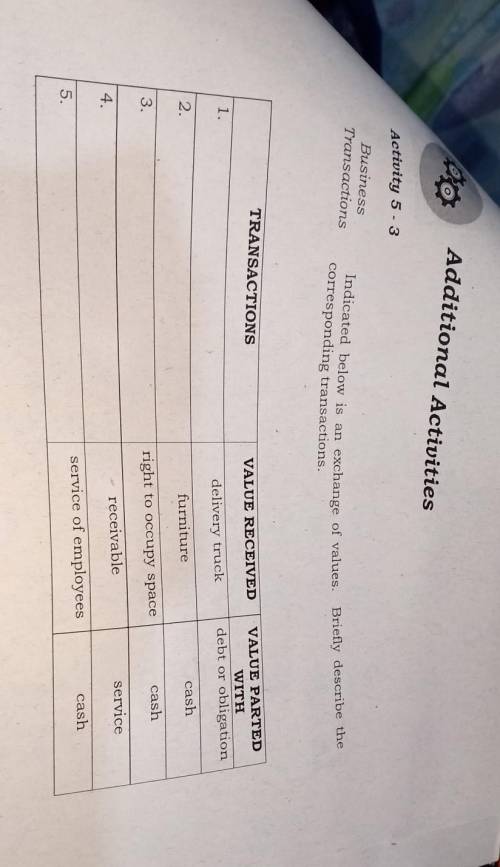

Activity 5 - 3

Business

Transactions

corresponding tra...

Po

Additional Activities

Activity 5 - 3

Business

Transactions

corresponding transactions.

TRANSACTIONS

VALUE RECEIVED

VALUE PARTED

WITH

debt or obligation

1.

delivery truck

cash

2.

furniture

cash

3.

right to occupy space

service

receivable

4.

cash

service of employees

5.

Indicated below is an exchange of values. Briefly describe the

Answers: 3

Another question on Business

Business, 22.06.2019 02:30

On january 1, 2018, jay company acquired all the outstanding ownership shares of zee company. in assessing zee's acquisition-date fair values, jay concluded that the carrying value of zee's long-term debt (8-year remaining life) was less than its fair value by $21,600. at december 31, 2018, zee company's accounts show interest expense of $14,440 and long-term debt of $380,000. what amounts of interest expense and long-term debt should appear on the december 31, 2018, consolidated financial statements of jay and its subsidiary zee? long-term debt $401,600 $398,900 $401,600 $398,900 interest expense $17,140 $17,140 $11,740 $11,740 a. b. c. d.

Answers: 3

Business, 22.06.2019 11:30

Consider derek's budget information: materials to be used totals $64,750; direct labor totals $198,400; factory overhead totals $394,800; work in process inventory january 1, $189,100; and work in progress inventory on december 31, $197,600. what is the budgeted cost of goods manufactured for the year? a. $1,044,650 b. $649,450 c. $657,950 d. $197,600

Answers: 3

Business, 22.06.2019 17:30

Kevin and jenny, who are both working full-time, have three children all under the age of ten. the two youngest children, who are three and five years old, attended eastside pre-school for a total cost of $3,000. ervin, who is nine, attended big kid daycare after school at a cost of $2,000. jenny has earned income of $15,000 and kevin earns $14,000. what amount of childcare expenses should be used to determine the child and dependent care credit?

Answers: 3

Business, 22.06.2019 23:10

Mr. pines is considering buying a house and renting it to students. the yearly operating costs are $1,900. the house can be sold for $175,000 at the end of 10 years and it is considered 18% to be a suitable annual effective interest rate. if the house costs $100,000 to purchase, how much would you need to charge your tenants each year in rent? (assume a single payment for the years rent at the end of each year)

Answers: 1

You know the right answer?

Questions

Chemistry, 23.06.2020 22:01

Mathematics, 23.06.2020 22:01

Mathematics, 23.06.2020 22:01

Mathematics, 23.06.2020 22:01

Mathematics, 23.06.2020 22:01

Mathematics, 23.06.2020 22:01

Mathematics, 23.06.2020 22:01

Mathematics, 23.06.2020 22:01

History, 23.06.2020 22:01

Mathematics, 23.06.2020 22:01

History, 23.06.2020 22:01

Mathematics, 23.06.2020 22:01