Business, 02.11.2020 16:50 eaglesjohnson414

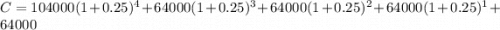

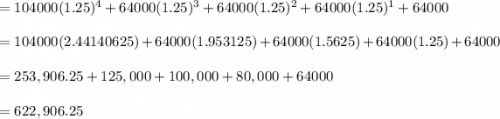

Lesco Chemical is considering two processes for making a cationic polymer. Process A has a first cost of $104,000 and an annual operating cost (AOC) of $64,000 per year. The first cost of process B is $165,000. If both processes will be adequate for 4 years and the rate of return on the increment between the alternatives is 25%, what is the amount of the AOC for process B

Answers: 1

Another question on Business

Business, 22.06.2019 01:00

How does the economy of cuba differ from the economy of north korea? in north korea, the government’s control of the economy has begun to loosen. in cuba, the government maintains a tight hold over the economy. in cuba, the government’s control of the economy has begun to loosen. in north korea, the government maintains a tight hold over the economy. in north korea, there is economic uncertainty in exchange for individual choice. in cuba, there is economic security in exchange for government control. in cuba, there is economic uncertainty in exchange for individual choice. in north korea, there is economic security in exchange for government control.\

Answers: 2

Business, 22.06.2019 16:10

The following are line items from the horizontal analysis of an income statement:increase/ (decrease) increase/ (decrease) 2017 2016 amount percent fees earned $120,000 $100,000 $20,000 20% wages expense 50,000 40,000 10,000 25 supplies expense 2,000 1,700 300 15 which of the items is stated incorrectly? a. fees earned b. supplies expense c. none of these choices are correct. d. wages expense

Answers: 3

Business, 23.06.2019 00:00

Both a demand curve and a demand schedule show how a. prices affect consumer demand. b. consumer demand affects income. c. prices affect complementary goods. d. consumer demand affects substitute goods.

Answers: 2

Business, 23.06.2019 02:50

Marcus nurseries inc.'s 2005 balance sheet showed total common equity of $2,050,000, which included $1,750,000 of retained earnings. the company had 100,000 shares of stock outstanding which sold at a price of $57.25 per share. if the firm had net income of $250,000 in 2006 and paid out $100,000 as dividends, what would its book value per share be at the end of 2006, assuming that it neither issued nor retired any common stock?

Answers: 1

You know the right answer?

Lesco Chemical is considering two processes for making a cationic polymer. Process A has a first cos...

Questions

Biology, 09.12.2019 14:31

Mathematics, 09.12.2019 14:31

History, 09.12.2019 14:31

History, 09.12.2019 14:31

Chemistry, 09.12.2019 14:31

History, 09.12.2019 14:31

Mathematics, 09.12.2019 14:31

Mathematics, 09.12.2019 14:31

Chemistry, 09.12.2019 14:31

Physics, 09.12.2019 14:31

Mathematics, 09.12.2019 14:31

Mathematics, 09.12.2019 14:31

History, 09.12.2019 14:31

![622,906.25=165000(1+0.25)^4+x(1+0.25)^3+x(1+0.25)^2+x(1+0.25)+x \\\\622,906.25=402832.0313+x(1.25)^3+x(1.25)^2+x(1.25)+x\\\\220074.219=x[(1.25)^3+(1.25)^2+(1.25)+1]\\\\220074.219=x[5.765625]\\\\x= \frac{220074.219}{5.765625} \\\\ x= 38170.0542](/tpl/images/0860/1900/a36ff.png)