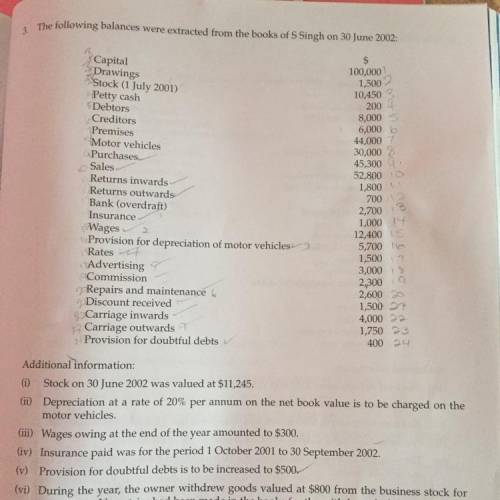

3. The following balances were extracted from the books of S Singh on 30 June 2002:

$

100,000...

Business, 01.11.2020 20:30 monstergirl25

3. The following balances were extracted from the books of S Singh on 30 June 2002:

$

100,000

1,500

10,450

200

8,000

6,000

44,000

30,000

45,300

52,800

1,800

700

Capital

Drawings

Stock (1 July 2001)

Petty cash

Debtors

Creditors

Premises

Motor vehicles

Purchases

Sales

Returns inwards

Returns outwards

Bank (overdraft)

Insurance

Wages

Provision for depreciation of motor vehicles

Rates

Advertising

Commission

Repairs and maintenance

Discount received

9 Carriage inwards

Carriage outwards

Provision for doubtful debts

2,700

1,000

12,400

5,700

1,500

3,000

2,300

2,600

1,500

4,000

1,750

400

Additional information:

(i) Stock on 30 June 2002 was valued at $11,245.

(ii) Depreciation at a rate of 20% per annum on the net book value is to be charged on the

motor vehicles.

(iii) Wages owing at the end of the year amounted to $300.

(iv) Insurance paid was for the period 1 October 2001 to 30 September 2002.

(v) Provision for doubtful debts is to be increased to $500.

(vi) During the year, the owner withdrew goods valued at $800 from the business stock for

private use. No entries had been made in the books for the withdrawal of these goods.

You are required to prepare the:

(a) Trading and Profit and Loss Account for the year ended 30 June 2002;

(b) Balance Sheet as at 30 June 2002.

Answers: 2

Another question on Business

Business, 21.06.2019 19:20

What impact did the economic opportunities in pennsylvania and new york have on virginia? a. virginia planters started to migrate to new york. b. new yorkers began buying up cheap virginia real estate. c. virginians found themselves resorting increasingly to slavery. d. virginians loosened their slave laws to attract more migrants.

Answers: 2

Business, 21.06.2019 22:30

Abusiness cycle reflects in economic activity, particularly real gdp. the stages of a business cycle

Answers: 2

Business, 21.06.2019 23:20

On october 2, 2016 starbucks corporation reported, on its form 10-k, the following (in millions): total assets $14,329.5 total stockholders' equity 5,890.7 total current liabilities 4,546.9 what did starbucks report as total liabilities on october 2, 2016? select one: a. $12,516.7 million b. $6,377.3 million c. $995.0 million d. $8,438.8 million e. none of the above

Answers: 2

Business, 22.06.2019 07:30

Net income and owner's equity for four businesses four different proprietorships, jupiter, mars, saturn, and venus, show the same balance sheet data at the beginning and end of a year. these data, exclusive of the amount of owner's equity, are summarized as follows: total assets total liabilities beginning of the year $550,000 $215,000 end of the year 844,000 320,000 on the basis of the preceding data and the following additional information for the year, determine the net income (or loss) of each company for the year. (hint: first determine the amount of increase or decrease in owner's equity during the year.) jupiter: the owner had made no additional investments in the business and had made no withdrawals from the business. mars: the owner had made no additional investments in the business but had withdrawn $36,000. saturn: the owner had made an additional investment of $60,000 but had made no withdrawals. venus: the owner had made an additional investment of $60,000 and had withdrawn $36,000. jupiter net income $ mars net income $ saturn net income $ venus net income $

Answers: 3

You know the right answer?

Questions

Mathematics, 31.08.2020 05:01

Mathematics, 31.08.2020 05:01

Mathematics, 31.08.2020 05:01

Mathematics, 31.08.2020 05:01

Mathematics, 31.08.2020 05:01

Mathematics, 31.08.2020 05:01

History, 31.08.2020 05:01

Mathematics, 31.08.2020 05:01

Mathematics, 31.08.2020 05:01

Mathematics, 31.08.2020 05:01

Mathematics, 31.08.2020 05:01

English, 31.08.2020 05:01