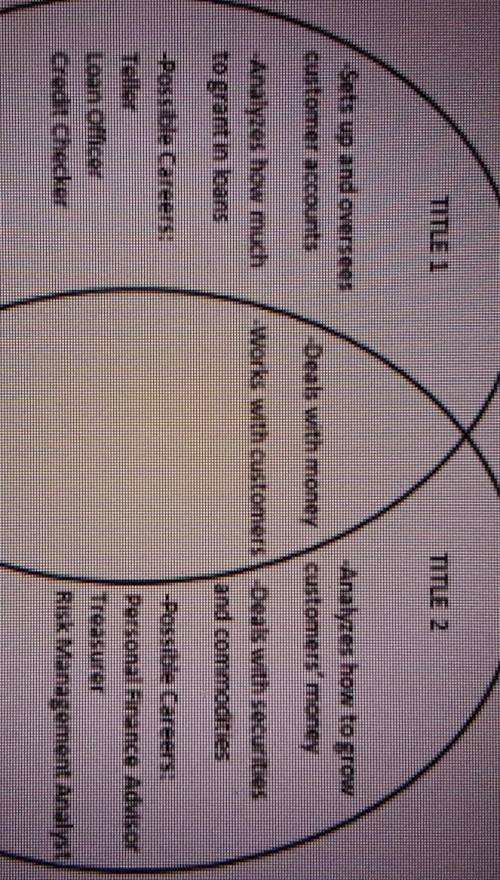

Shirine has been debating between two career pathways in finance. She creates a Venn diagram to compare the two careers. In a Venn diagram, the separate circles contain characteristics unique to each item being compared and the intersection contains characteristics that are common to both items being compared. This is the Venn diagram that Shirine creates:

Which accurately labels the titles in Shirine's diagram?

A) Title 1 should be Investment Career Pathway, and Title 2 should be Banking Career Pathway

B) Title 1 should be Banking Career Pathway, and Title 2 should be Investment Career Pathway

C) Title 1 should be Banking Career Pathway, and Title 2 should be Financial Career Pathway

D) Title 1 should be Financial Management Career Pathway, and Title 2 should be Investment Career Pathway

Answers: 2

Another question on Business

Business, 22.06.2019 20:10

Quick computing currently sells 12 million computer chips each year at a price of $19 per chip. it is about to introduce a new chip, and it forecasts annual sales of 22 million of these improved chips at a price of $24 each. however, demand for the old chip will decrease, and sales of the old chip are expected to fall to 6 million per year. the old chips cost $10 each to manufacture, and the new ones will cost $14 each. what is the proper cash flow to use to evaluate the present value of the introduction of the new chip? (enter your answer in millions.)

Answers: 1

Business, 22.06.2019 21:20

Which of the following best describes the advantage of living in a suburban area? a. suburbs give people access to city jobs along with more living space. b. suburbs give people easy access to cultural attractions and high-paying jobs. c. suburbs have the widest availability of low-cost housing of any living area. d. suburbs have the lowest population density of any living area.

Answers: 1

Business, 22.06.2019 22:00

You wish to retire in 13 years, at which time you want to have accumulated enough money to receive an annual annuity of $23,000 for 18 years after retirement. during the period before retirement you can earn 9 percent annually, while after retirement you can earn 11 percent on your money. what annual contributions to the retirement fund will allow you to receive the $23,000 annuity? use appendix c and appendix d for an approximate answer, but calculate your final answer using the formula and financial calculator methods.

Answers: 1

Business, 22.06.2019 23:30

Sole proprietorships produce more goods and services than does any other form of business organization.

Answers: 2

You know the right answer?

Shirine has been debating between two career pathways in finance. She creates a Venn diagram to comp...

Questions

Chemistry, 03.09.2021 04:30

Mathematics, 03.09.2021 04:30

Computers and Technology, 03.09.2021 04:30

Chemistry, 03.09.2021 04:30

Mathematics, 03.09.2021 04:30

Mathematics, 03.09.2021 04:30

Mathematics, 03.09.2021 04:30

Mathematics, 03.09.2021 04:40

English, 03.09.2021 04:40

Mathematics, 03.09.2021 04:40