Business, 29.10.2020 17:30 xaniawashington

Please somebody help

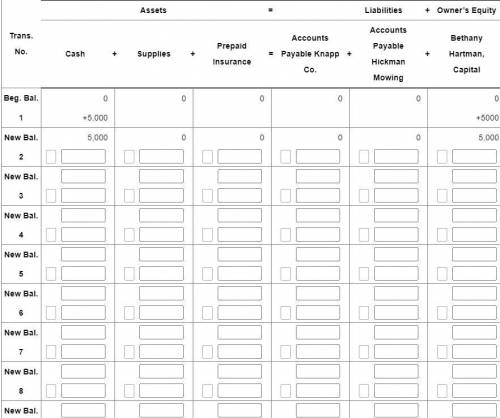

"Bethany Hartman is starting Hartman’s Lawn Service, a small service business. Hartman’s uses the accounts shown in the following equation. For each transaction, complete the following: (a) Analyze the transaction to determine which accounts in the accounting equation are affected. (b) In the appropriate columns, enter a plus sign (+) if the account increases or a minus sign (–) if the account decreases, and then enter the amount. (c) Calculate and enter a new balance for each transaction in the accounting equation. (d) Before going on to the next transaction, determine that the accounting equation is still in balance. Transaction 1 is given as an example."

1. Received cash from owner as an investment, $5,000.00.

2. Paid cash for insurance, $1,800.00.

3. Bought supplies on account from Hickman Mowing, $700.00.

4. Bought supplies on account from Knapp Co., $200.00.

5. Paid cash on account to Hickman Mowing, $300.00.

6. Paid cash for supplies, $100.00.

7. Paid cash on account to Knapp Co., $100.00.

8. Received cash from owner as an investment, $1,000.00.

Answers: 2

Another question on Business

Business, 22.06.2019 02:20

Each month, business today publishes a news piece about an innovative product, service, or business. such soft news is generally written by a freelance business writer and is known as a

Answers: 2

Business, 22.06.2019 03:20

Yael decides that she no longer enjoys her job, and she quits to open a gluten-free, dairy-free kosher bakery. she pays a monthly rent for her store of $2,000. her labor costs for one month are $4,500, and she spends $6,000 a month on nut flours, sugar, and other supplies. yael was earning $2,500 a month working as a bank teller. these are her only costs. her monthly revenue is $14,000. which of the following statements about yael’s costs and profit are correct? correct answer(s) an accountant would say she is earning a monthly profit of $1,500. her implicit costs are $2,500 a month. an economist would tell her that she is experiencing a loss. her total costs are $12,500 a month. her explicit costs include the labor, rent, and supplies for her store. her economic profit is $1,500 a month.

Answers: 3

Business, 22.06.2019 06:20

James albemarle created a trust fund at the beginning of 2016. the income from this fund will go to his son edward. when edward reaches the age of 25, the principal of the fund will be conveyed to united charities of cleveland. mr. albemarle specified that 75 percent of trustee fees are to be paid from principal. terry jones, cpa, is the trustee. james albemarle transferred cash of $500,000, stocks worth $400,000, and rental property valued at $250,000 to the trustee of this fund. immediately invested cash of $360,000 in bonds issued by the u.s. government. commissions of $7,900 are paid on this transaction. incurred permanent repairs of $9,000 so that the property can be rented. payment is made immediately. received dividends of $8,000. of this amount, $3,000 had been declared prior to the creation of the trust fund. paid insurance expense of $4,000 on the rental property. received rental income of $10,000. paid $8,000 from the trust for trustee services rendered. conveyed cash of $7,000 to edward albemarle.

Answers: 2

Business, 22.06.2019 09:30

Oliver's company is planning the launch of their hybrid cars. the company has included "never-before-seen" product benefits in the hybrid cars. which type of advertising should oliver's company use for the new cars?

Answers: 1

You know the right answer?

Please somebody help

"Bethany Hartman is starting Hartman’s Lawn Service, a small service business....

Questions

Mathematics, 30.05.2021 01:00

Mathematics, 30.05.2021 01:00

Mathematics, 30.05.2021 01:00

English, 30.05.2021 01:00

Mathematics, 30.05.2021 01:00

Mathematics, 30.05.2021 01:00

Chemistry, 30.05.2021 01:00