Business, 24.10.2020 07:00 sofiisabella10

Please please help me i have exam now

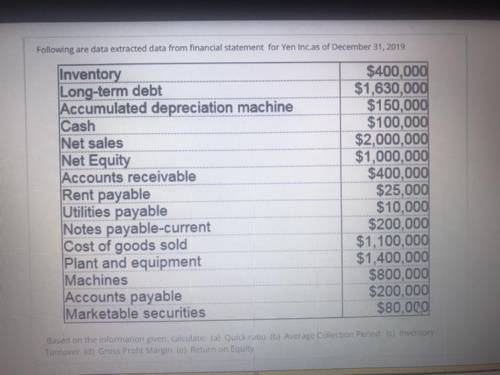

Following are data extracted data from financial statement for Yen Inc. as of December 31, 2019

Inventory

Long-term debt

Accumulated depreciation machine

Cash

Net sales

Net Equity

Accounts receivable

Rent payable

Utilities payable

Notes payable-current

Cost of goods sold

Plant and equipment

Machines

Accounts payable

Marketable securities

$400,000

$1,630,000

$150,000

$100,000

$2,000,000

$1,000,000

$400,000

$25,000

$10,000

$200,000

$1,100,000

$1,400,000

$800,000

$200,000

$80,000

Based on the information given, calculate: (a) Quick ratio (b) Average Collection Period () Inventory

Turnover (d) Gross Profit Margin (e) Return on Equity

Answers: 2

Another question on Business

Business, 22.06.2019 07:30

When the national economy goes from bad to better, market research shows changes in the sales at various types of restaurants. projected 2011 sales at quick-service restaurants are $164.8 billion, which was 3% better than in 2010. projected 2011 sales at full-service restaurants are $184.2 billion, which was 1.2% better than in 2010. how will the dollar growth in quick-service restaurants sales compared to the dollar growth for full-service places?

Answers: 2

Business, 22.06.2019 10:50

Bill dukes has $100,000 invested in a 2-stock portfolio. $62,500 is invested in stock x and the remainder is invested in stock y. x's beta is 1.50 and y's beta is 0.70. what is the portfolio's beta? do not round your intermediate calculations. round the final answer to 2 decimal places.

Answers: 2

Business, 22.06.2019 17:30

Communication comes in various forms. which of the following is considered an old form of communication? a) e-mail b) letter c) skype d) texting

Answers: 2

Business, 22.06.2019 17:50

Variable rate cd’s = $90 treasury bills = $150 discount loans = $20 treasury notes = $100 fixed rate cds = $160 money market deposit accts. = $140 savings deposits = $90 fed funds borrowing = $40 variable rate mortgage loans $140 demand deposits = $40 primary reserves = $50 fixed rate loans = $210 fed funds lending = $50 equity capital = $120 a. develop a balance sheet from the above data. be sure to divide your balance sheet into rate-sensitive assets and liabilities as we did in class and in the examples. b. perform a standard gap analysis and a duration analysis using the above data if you have a 1.15% decrease in interest rates and an average duration of assets of 5.4 years and an average duration of liabilities of 3.8 years. c. indicate if this bank will remain solvent after the valuation changes. if so, indicate the new level of equity capital after the valuation changes. if not, indicate the amount of the shortage in equity capital.

Answers: 3

You know the right answer?

Please please help me i have exam now

Following are data extracted data from financial statement fo...

Questions

Mathematics, 18.03.2021 20:10

Chemistry, 18.03.2021 20:10

Spanish, 18.03.2021 20:10

Mathematics, 18.03.2021 20:10

Mathematics, 18.03.2021 20:10

Mathematics, 18.03.2021 20:10

Biology, 18.03.2021 20:10

English, 18.03.2021 20:10