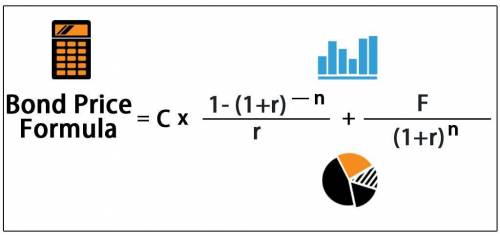

Assume that a $1,000,000 par value, semiannual coupon US Treasury note with three years to maturity has a coupon rate of 6%. The yield to maturity (YTM) of the bond is 9.90%. Using this information and ignoring the other costs involved, calculate the value of the Treasury note:

Answers: 3

Another question on Business

Business, 22.06.2019 12:50

In june 2009, at the trough of the great recession, the bureau of labor statistics announced that of all adult americans, 140,196,000 were employed, 14,729,000 were unemployed and 80,729,000 were not in the labor force. use this information to calculate: a. the adult population b. the labor force c. the labor-force participation rate d. the unemployment rate

Answers: 3

Business, 22.06.2019 16:30

Which of the following has the largest impact on opportunity cost

Answers: 3

Business, 22.06.2019 23:00

The quinoa seed is in high demand in wealthier countries such as the u.s. and japan. approximately 97% of all quinoa production comes from small farmers in bolivia and peru who farm at high elevations—8,000 feet or higher. the seed is considered highly nutritious. mostly grown and harvested in bolivia and peru, and sold to markets in other countries, the seed is now considered an important for these nations. the governments of bolivia and peru are hopeful that this product will increase the quality of life of their farmers.

Answers: 3

You know the right answer?

Assume that a $1,000,000 par value, semiannual coupon US Treasury note with three years to maturity...

Questions

History, 09.07.2019 13:00

Biology, 09.07.2019 13:00

Biology, 09.07.2019 13:00

Chemistry, 09.07.2019 13:00

History, 09.07.2019 13:00

History, 09.07.2019 13:00

Computers and Technology, 09.07.2019 13:00

Biology, 09.07.2019 13:00

Biology, 09.07.2019 13:00

Social Studies, 09.07.2019 13:00

Chemistry, 09.07.2019 13:00

History, 09.07.2019 13:00

Biology, 09.07.2019 13:00