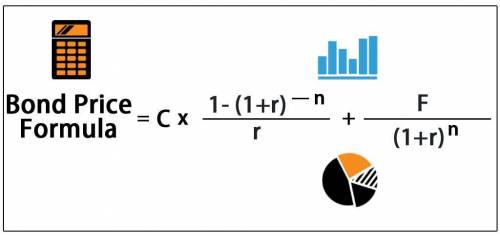

Your firm has a credit rating of BBB. You notice the credit spread for 5yr maturity BBB debt is 1.1% or 110 basis points. Your firm's 5yr debt has a coupon rate of 6% with annual payments. You see that new 5yr Treasury bonds are being issued at par with a coupon rate of 2.6%. What should the price of your outstanding 5yr bonds be per $100 face value? a. $110.33.b. $115.75.c. $123.71.d. $112.54.

Answers: 3

Another question on Business

Business, 22.06.2019 12:40

Alarge tank is filled to capacity with 500 gallons of pure water. brine containing 2 pounds of salt per gallon is pumped into the tank at a rate of 5 gal/min. the well-mixed solution is pumped out at the same rate. find the number a(t) of pounds of salt in the tank at time t.

Answers: 3

Business, 22.06.2019 20:00

Qwest airlines has implemented a program to recycle all plastic drink cups used on their aircraft. their goal is to generate $7 million by the end of the recycle program's five-year life. each recycled cup can be sold for $0.005 (1/2 cent). a. how many cups must be recycled annually to meet this goal? assume uniform annual plastic cup usage and a 0% interest rate. b. repeat part (a) when the annual interest rate is 12%. c. why is the answer to part (b) less than the answer to part (a)?

Answers: 1

Business, 22.06.2019 22:00

As a general rule, when accountants calculate profit they account for explicit costs but usually ignorea. certain outlays of money by the firm.b. implicit costs.c. operating costs.d. fixed costs.

Answers: 2

Business, 22.06.2019 23:00

How is challah bread made? if i have to dabble the recipe?

Answers: 1

You know the right answer?

Your firm has a credit rating of BBB. You notice the credit spread for 5yr maturity BBB debt is 1.1%...

Questions

Mathematics, 19.02.2022 04:30

Mathematics, 19.02.2022 04:30

Business, 19.02.2022 04:40

Mathematics, 19.02.2022 04:40

Mathematics, 19.02.2022 04:40

Mathematics, 19.02.2022 04:40

Social Studies, 19.02.2022 04:40

Mathematics, 19.02.2022 04:40