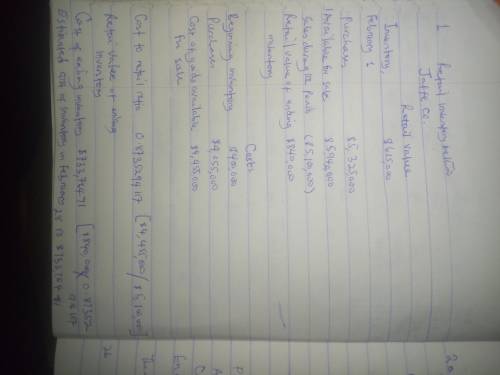

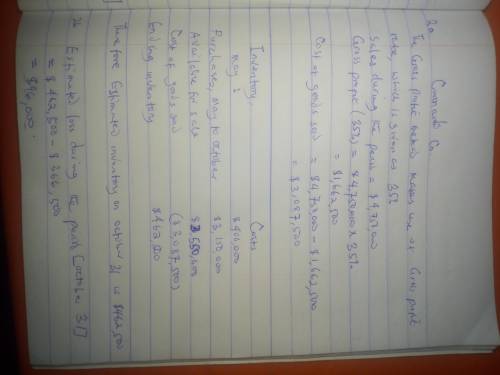

Retail Method; Gross Profit Method Selected data on merchandise inventory, purchases, and sales for Jaffe Co. and Coronado Co. are as follows: Cost Retail Jaffe Co. Merchandise inventory, February 1 $400,000 $615,000 Transactions during February: Purchases (net) 4,055,000 5,325,000 Sales 5,100,000 Coronado Co. Merchandise inventory, May 1 $400,000 Transactions during May through October: Purchases (net) 3,150,000 Sales 4,750,000 Estimated gross profit rate 35% Required: 1. Determine the estimated cost of the merchandise inventory of Jaffe Co. on February 28 by the retail method, presenting details of the computations. Jaffe Co. Cost of the Merchandise Inventory February 28 Cost Retail $ $ $ $ Ratio of cost to retail price: % $ $ 2a. Estimate the cost of the merchandise inventory of Coronado Co. on October 31 by the gross profit method, presenting details of the computations.

Answers: 3

Another question on Business

Business, 21.06.2019 21:30

Unrecorded depreciation on the trucks at the end of the year is $40,000. the total amount of accrued interest expense at year-end is $6,000. the cost of unused office supplies still available at year-end is $2,000. 1. use the above information about the company’s adjustments to complete a 10-column work sheet. 2a. prepare the year-end closing entries for dylan delivery company as of december 31, 2017. 2b. determine the capital amount to be reported on the december 31, 2017 balance sheet.

Answers: 1

Business, 22.06.2019 01:00

Granby foods' (gf) balance sheet shows a total of $25 million long-term debt with a coupon rate of 8.50%. the yield to maturity on this debt is 8.00%, and the debt has a total current market value of $27 million. the company has 10 million shares of stock, and the stock has a book value per share of $5.00. the current stock price is $20.00 per share, and stockholders' required rate of return, r s, is 12.25%. the company recently decided that its target capital structure should have 35% debt, with the balance being common equity. the tax rate is 40%. calculate waccs based on book, market, and target capital structures. what is the sum of these three waccs?

Answers: 3

Business, 22.06.2019 03:00

Match each item to check for while reconciling a bank account with the document to which it relates. (there's not just one answer) 1. balancing account statement 2. balancing check register a. nsf fees b. deposits in transit c. interest earned d. bank errors

Answers: 3

Business, 22.06.2019 11:00

You are attending college in the fall and you need to purchase a computer. you must finance the purchase because your parents will not purchase it for you, and you do not have the cash on hand to purchase it. in blank #1 determine which type of credit would you use to finance your purchase (installment, non-installment, or revolving credit). (2 points) in blank #2 defend your credit choice by explaining why your financing option is the best option for you. (2 points) in blank #3 explain why you selected that credit option over the other two options available. (2 points)

Answers: 3

You know the right answer?

Retail Method; Gross Profit Method Selected data on merchandise inventory, purchases, and sales for...

Questions

Mathematics, 11.11.2020 19:20

Chemistry, 11.11.2020 19:20

Chemistry, 11.11.2020 19:20

Business, 11.11.2020 19:20

Mathematics, 11.11.2020 19:20

Chemistry, 11.11.2020 19:20

Business, 11.11.2020 19:20

Mathematics, 11.11.2020 19:20

Mathematics, 11.11.2020 19:20

Mathematics, 11.11.2020 19:20

Mathematics, 11.11.2020 19:20

Advanced Placement (AP), 11.11.2020 19:20