Business, 17.10.2020 14:01 deasiamonay14

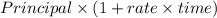

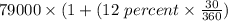

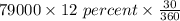

Duerr Company makes a $79,000, 30-day, 12% cash loan to Ryan Co. The note and interest to be collected at maturity is:

Answers: 1

Another question on Business

Business, 22.06.2019 06:00

According to herman, one of the differences of managing a nonprofit versus a for-profit corporation is

Answers: 1

Business, 22.06.2019 11:00

Your debit card is stolen, and you report it to your bank within two business days. how much money can you lose at most? a. $500 b. $25 c. $50 d. $150

Answers: 2

Business, 22.06.2019 12:30

Acorporation a. can use different depreciation methods for tax and financial reporting purposes b. must use the straight - line depreciation method for tax purposes and double declining depreciation method financial reporting purposes c. must use different depreciation method for tax purposes, but strictly mandated depreciation methods for financial reporting purposes d. can use straight- line depreciation method for tax purposes and macrs depreciation method financial reporting purposes

Answers: 2

Business, 22.06.2019 14:30

Bridge building company estimates that it will incur $1,200,000 in overhead costs for the year. additionally, the company estimates 50,000 direct labor hours will be spent building custom walking bridges for the year at a total direct labor cost of $600,000. what is the predetermined overhead rate for bridge building company if direct labor costs are to be used as an allocation base?

Answers: 3

You know the right answer?

Duerr Company makes a $79,000, 30-day, 12% cash loan to Ryan Co. The note and interest to be collect...

Questions

Mathematics, 06.03.2020 18:05

Computers and Technology, 06.03.2020 18:05

Mathematics, 06.03.2020 18:06

Mathematics, 06.03.2020 18:06

Mathematics, 06.03.2020 18:07

($)

($)