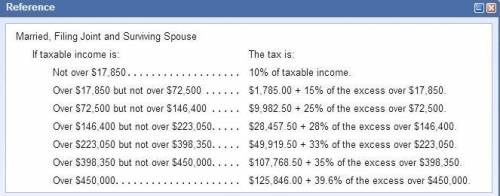

Jill and George are married and file a joint return. They expect to have $410,000 of taxable income in the next year and are considering whether to purchase a personal residence that would provide additional tax deductions of $80.000 for mortgage interest and real estate taxes.

Not over $17,850 10% of taxable income.

Over $17,850 but not over $72,500 $1,78500 + 15% of the excess over $17,850.

Over $72,500 but not over $146,400 $9,982.50 + 25% of the excess over $72,500.

Over $146,400 but not over $223,050 $28,45780 + of the excess over $146,400.

Over $223,050 but not over $398,350 S49,919S0 + of the excess over $223,050.

Over $398,350 but not over $450,000 $107,76840 + of the excess over $398,350.

Over $450,000 $125,846ff + 39.6 of the excess over $450,000.

Required:

a. What is their marginal tax rate for purposes of making this decision?

b. What is the tax savings if the residence is acquired?

Answers: 3

Another question on Business

Business, 22.06.2019 15:30

Careers in designing, planning, managing, building and maintaining the built environment can be found in the following career cluster: a. agriculture, food & natural resources b. architecture & construction c. arts, audio-video technology & communications d. business, management & administration

Answers: 2

Business, 22.06.2019 18:30

Hilary works at klothes kloset. she quickly the customers, and her cash drawer is always correct at the end of her shift. however, she never tries to "upsell" the customers (for example, by asking if they would like to purchase earrings to go with the shirt they chose or by suggesting a purse that matches the shoes they are buying). give hilary some constructive feedback on her performance.

Answers: 3

Business, 22.06.2019 23:00

You cannot make copies of media, even as a personal backup, without violating copyright. true

Answers: 3

Business, 23.06.2019 00:00

Winston churchill's stamp collection was valued at $14 million when he died. at auction, it brought in only $4 million. what was it worth? why?

Answers: 3

You know the right answer?

Jill and George are married and file a joint return. They expect to have $410,000 of taxable income...

Questions

Mathematics, 12.04.2020 05:43

Social Studies, 12.04.2020 05:43

Mathematics, 12.04.2020 05:43

Computers and Technology, 12.04.2020 05:44

Mathematics, 12.04.2020 05:44

English, 12.04.2020 05:44

Mathematics, 12.04.2020 05:44

Mathematics, 12.04.2020 05:44

Social Studies, 12.04.2020 05:44