Business, 15.10.2020 08:01 alexmiranda00

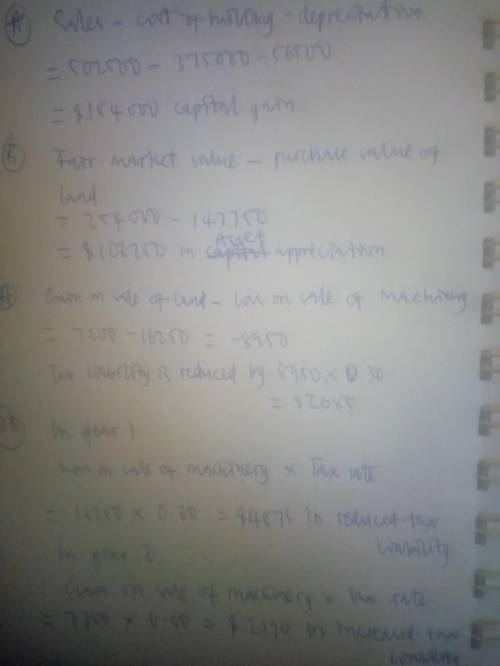

Luke sold a building and the land on which the building sits to his wholly owned corporation, Studemont Corp. at fair market value. The fair market value of the building was determined to be $502,500; Luke built the building several years ago at a cost of $375,000. Luke had claimed $56,500 of depreciation expense on the building. The fair market value of the land was determined to be $254,000 at the time of the sale; Luke purchased the land many years ago for $147,750.a. What is the amount and character of Luke’s recognized gain or loss on the building?b. What is the amount and character of Luke’s recognized gain or loss on the land?Aruna, a sole proprietor, wants to sell two assets that she no longer needs for her business. Both assets qualify as §1231 assets. The first is machinery and will generate a $16,250 §1231 loss on the sale. The second is land that will generate a $7,300 §1231 gain on the sale. Aruna’s ordinary marginal tax rate is 30 percent. (Input all amounts as positive values.)a. Assuming she sells both assets in December of year 1 (the current year), what effect will the sales have on Aruna’s tax liability?b. Assuming that Aruna sells the land in December of year 1 and the machinery in January of year 2, what effect will the sales have on Aruna’s tax liability for each year?

Answers: 3

Another question on Business

Business, 22.06.2019 19:00

The starr theater, owned by meg vargo, will begin operations in march. the starr will be unique in that it will show only triple features of sequential theme movies. as of march 1, the ledger of starr showed: cash $3,150, land $22,000, buildings (concession stand, projection room, ticket booth, and screen) $10,000, equipment $10,000, accounts payable $7,300, and owner’s capital $37,850. during the month of march, the following events and transactions occurred.mar. 2 rented the three indiana jones movies to be shown for the first 3 weeks of march. the film rental was $3,600; $1,600 was paid in cash and $2,000 will be paid on march 10.3 ordered the lord of the rings movies to be shown the last 10 days of march. it will cost $200 per night.9 received $4,500 cash from admissions.10 paid balance due on indiana jones movies rental and $2,200 on march 1 accounts payable.11 starr theater contracted with adam ladd to operate the concession stand. ladd is to pay 15% of gross concession receipts, payable monthly, for the rental of the concession stand.12 paid advertising expenses $900.20 received $5,100 cash from customers for admissions.20 received the lord of the rings movies and paid the rental fee of $2,000.31 paid salaries of $2,900.31 received statement from adam ladd showing gross receipts from concessions of $6,000 and the balance due to starr theater of $900 ($6,000 × 15%) for march. ladd paid one-half the balance due and will remit the remainder on april 5.31 received $9,200 cash from customers for admissions.1.) enter the beginning balances in the ledger.2.) journalize the march transactions. starr records admission revenue as service revenue, rental of the concession stand as rent revenue, and film rental expense as rent expense. (credit account titles are automatically indented when the amount is entered. do not indent manually. record journal entries in the order presented in the problem. if no entry is required, select "no entry" for the account titles and enter 0 for the amounts.)3.) post the march journal entries to the ledger. (post entries in the order of journal entries presented in the previous question.)

Answers: 3

Business, 22.06.2019 20:20

Why is it easier for new entrants to get involved in radical innovations when compared to incumbent firms? a. unlike incumbent firms, new entrants do not have to face the high entry barriers, initially. b. new entrants are embedded in an innovation ecosystem, while incumbent firms are not. c. unlike incumbent firms, new entrants do not have formal organizational structures and processes. d. incumbent firms do not have the advantages of network effects that new entrants have.

Answers: 2

Business, 22.06.2019 21:10

Your family business uses a secret recipe to produce salsa and distributes it through both smaller specialty stores and chain supermarkets. the chain supermarkets have been demanding sizable discounts, but you do not want to drop your prices to the specialty stores. true or false: the robinson-patman act limits your ability to offer discounts to the chain supermarkets while leaving the price high for the smaller stores. true false

Answers: 3

You know the right answer?

Luke sold a building and the land on which the building sits to his wholly owned corporation, Studem...

Questions

Physics, 23.06.2019 07:40

History, 23.06.2019 07:40

Mathematics, 23.06.2019 07:40

English, 23.06.2019 07:40

Health, 23.06.2019 07:40

History, 23.06.2019 07:40