Business, 12.10.2020 01:01 kandikisses2101

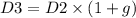

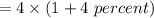

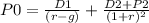

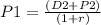

A company will pay a $2 per share dividend in 1 year. The dividend in 2 years will be $4 per share, and it is expected that dividends will grow at 2% per year thereafter. The expected rate of return on the stock is 12%. a. What is the current price of the stock? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What is the expected price of the stock in a year? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Answers: 2

Another question on Business

Business, 22.06.2019 12:40

Acompany has $80,000 in outstanding accounts receivable and it uses the allowance method to account for uncollectible accounts. experience suggests that 6% of outstanding receivables are uncollectible. the current credit balance (before adjustments) in the allowance for doubtful accounts is $1,200. the journal entry to record the adjustment to the allowance account includes a debit to bad debts expense for $4,800. true or false

Answers: 3

Business, 22.06.2019 12:50

Jallouk corporation has two different bonds currently outstanding. bond m has a face value of $50,000 and matures in 20 years. the bond makes no payments for the first six years, then pays $2,100 every six months over the subsequent eight years, and finally pays $2,400 every six months over the last six years. bond n also has a face value of $50,000 and a maturity of 20 years; it makes no coupon payments over the life of the bond. the required return on both these bonds is 10 percent compounded semiannually. what is the current price of bond m and bond n?

Answers: 3

Business, 22.06.2019 14:40

You are purchasing a bond that currently sold for $985.63. it has the time-to-maturity of 10 years and a coupon rate of 6%, paid semi-annually. the bond can be called for $1,020 in 3 years. what is the yield to maturity of this bond?

Answers: 2

You know the right answer?

A company will pay a $2 per share dividend in 1 year. The dividend in 2 years will be $4 per share,...

Questions

Mathematics, 22.08.2019 13:30

Computers and Technology, 22.08.2019 13:30

Mathematics, 22.08.2019 13:30

History, 22.08.2019 13:30

Mathematics, 22.08.2019 13:30

Mathematics, 22.08.2019 13:30

Geography, 22.08.2019 13:30

($)

($)

($)

($)

($)

($)

($)

($)