Business, 08.10.2020 14:01 Herbie3070

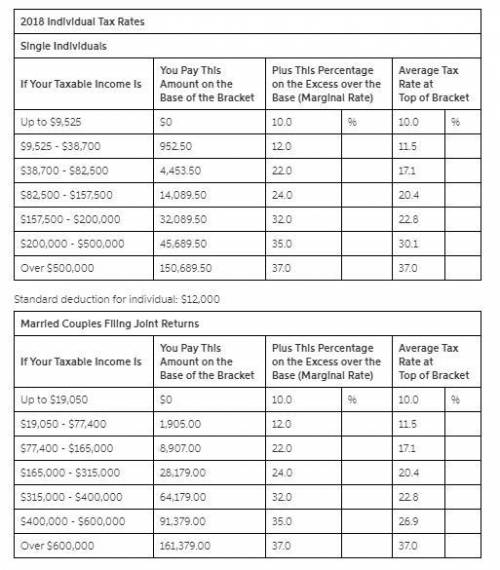

2018 Individual Tax Rates Single Individuals If Your Taxable Income Is You Pay This Amount on the Base of the Bracket Plus This Percentage on the Excess over the Base (Marginal Rate) Average Tax Rate at Top of Bracket Up to $9,525 $0 10.0 % 10.0 % $9,525 - $38,700 952.50 12.0 11.5 $38,700 - $82,500 4,453.50 22.0 17.1 $82,500 - $157,500 14,089.50 24.0 20.4 $157,500 - $200,000 32,089.50 32.0 22.8 $200,000 - $500,000 45,689.50 35.0 30.1 Over $500,000 150,689.50 37.0 37.0 Standard deduction for individual: $12,000 Married Couples Filing Joint Returns If Your Taxable Income Is You Pay This Amount on the Base of the Bracket Plus This Percentage on the Excess over the Base (Marginal Rate) Average Tax Rate at Top of Bracket Up to $19,050 $0 10.0 % 10.0 % $19,050 - $77,400 1,905.00 12.0 11.5 $77,400 - $165,000 8,907.00 22.0 17.1 $165,000 - $315,000 28,179.00 24.0 20.4 $315,000 - $400,000 64,179.00 32.0 22.8 $400,000 - $600,000 91,379.00 35.0 26.9 Over $600,000 161,379.00 37.0 37.0 Standard deduction for married couples filing jointly: $24,000 Quantitative Problem: Jenna is a single taxpayer. During 2018, she earned wages of $138,000. She doesn't itemize deductions, so she will take the standard deduction to calculate 2018 taxable income. In addition, during the year she sold common stock that she had owned for five years for a net profit of $4,400. How much does Jenna owe to the IRS for taxes

Answers: 3

Another question on Business

Business, 21.06.2019 19:20

Astock with a beta of 0.6 has an expected rate of return of 13%. if the market return this year turns out to be 10 percentage points below expectations, what is your best guess as to the rate of return on the stock? (do not round intermediate calculations. enter your answer as a percent rounded to 1 decimal place.)

Answers: 2

Business, 21.06.2019 23:00

Which of the following statements is correct? large corporations are taxed more favorably than sole proprietorships. corporate stockholders are exposed to unlimited liability. due to limited liability, unlimited lives, and ease of ownership transfer, the vast majority of u.s. businesses (in terms of number of businesses) are organized as corporations. most businesses (by number and total dollar sales) are organized as partnerships or proprietorships because it is easier to set up and operate in one of these forms rather than as a corporation. however, if the business gets very large, it becomes advantageous to convert to a corporation, mainly because corporations have important tax advantages over proprietorships and partnerships. most business (measured by dollar sales) is conducted by corporations in spite of large corporations’ often less favorable tax treatment, due to legal considerations related to ownership transfers and limited liability.

Answers: 3

Business, 22.06.2019 01:50

Amanda rice has just arranged to purchase a $640,000 vacation home in the bahamas with a 20 percent down payment. the mortgage has a 7 percent apr compounded monthly and calls for equal monthly payments over the next 30 years. her first payment will be due one month from now. however, the mortgage has an eight-year balloon payment, meaning that the balance of the loan must be paid off at the end of year 8. there were no other transaction costs or finance charges. how much will amanda’s balloon payment be in eight years

Answers: 3

Business, 22.06.2019 06:30

Selected data for stick’s design are given as of december 31, year 1 and year 2 (rounded to the nearest hundredth). year 2 year 1 net credit sales $25,000 $30,000 cost of goods sold 16,000 18,000 net income 2,000 2,800 cash 5,000 900 accounts receivable 3,000 2,000 inventory 2,000 3,600 current liabilities 6,000 5,000 compute the following: 1. current ratio for year 2 2. acid-test ratio for year 2 3. accounts receivable turnover for year 2 4. average collection period for year 2 5. inventory turnover for year 2

Answers: 2

You know the right answer?

2018 Individual Tax Rates Single Individuals If Your Taxable Income Is You Pay This Amount on the Ba...

Questions

Mathematics, 02.10.2020 17:01

World Languages, 02.10.2020 17:01

Mathematics, 02.10.2020 17:01

Mathematics, 02.10.2020 17:01

Mathematics, 02.10.2020 17:01

Mathematics, 02.10.2020 17:01

World Languages, 02.10.2020 17:01

Mathematics, 02.10.2020 17:01

Mathematics, 02.10.2020 17:01

Mathematics, 02.10.2020 17:01

Mathematics, 02.10.2020 17:01

Mathematics, 02.10.2020 17:01

English, 02.10.2020 17:01

World Languages, 02.10.2020 17:01

Law, 02.10.2020 17:01