Business, 07.10.2020 23:01 jenistha123

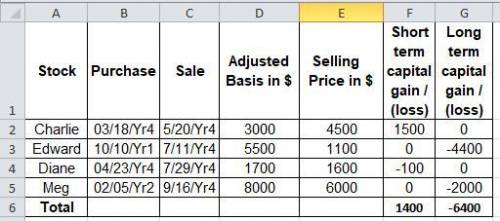

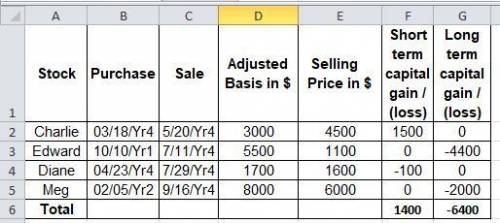

Mr. Smith, a single taxpayer, died in Year 4. His Year 4 taxable income of $40,000 included the following stock transactions: Adjusted Selling Stock Purchased Sold Basis Price Charlie 03/18/Yr 4 5/20/Yr 4 $3,000 $4,500 Edward 10/10/Yr 1 7/11/Yr 4 5,500 1,100 Diane 04/23/Yr 4 7/29/Yr 4 1,700 1,600 Meg 02/05/Yr 2 9/16/Yr 4 8,000 6,000 What is the amount of the capital loss deduction for Year 4 and the amount of the capital loss carryover to the decedent’s estate?

Answers: 2

Another question on Business

Business, 21.06.2019 20:30

According to the research in strategic human resources management,answers: firms that are able to use human resource practices to develop socially complex human and organizational resources are able to gain competitive advantage over firms that do not engage in these practices.firms that are able to use human resource practices to develop socially simplistic human and organizational resources are able to gain competitive advantage over firms that do not engage in these practices.firms that are able to use human resource practices to develop socially complex human and organizational resources gain little advantage over firms that do not engage in these practices.firms that are able to use human resource practices to develop socially complex human and organizational resources are at a competitive disadvantage when compared to firms that do not engage in these practices.

Answers: 3

Business, 23.06.2019 07:50

Tubby toys estimates that its new line of rubber ducks will generate sales of $7.60 million, operating costs of $4.60 million, and a depreciation expense of $1.60 million. if the tax rate is 35%, what is the firm’s operating cash flow? (enter your answer in millions rounded to 2 decimal places.)

Answers: 1

Business, 23.06.2019 13:20

Which type of tax is imposed on specific goods and services at the time of purchase? question 12 options: estate excise general sales value-added

Answers: 1

Business, 23.06.2019 17:00

Shawshank real estate agency. oct. 1 pete shawshank begins business as a real estate agent with a cash investment of $25,000 in exchange for common stock. 2 hires an administrative assistant. 3 purchases office furniture for $2,900, by paying $700 cash with the balance on account. 6 sells a house and lot for n. kidman, earning a fee of $3,600, with $600 collected in cash and the balance billed to n. kidman. 27 pays $900 on the balance related to the transaction of october 3. 30 pays the administrative assistant $2,300 in salary for october. 31 collects $1,200 of the balance owed by n. kidman. instructions: (a) journalize the transactions. (you may omit explanations.) (b) what balance would shawshank real estate agency report for accounts payable in its october 31 financial statements? in which category of which financial statements would it be found? (c) what balance would shawshank real estate agency report for accounts receivable in its october 31 financial statements? in which category of which financial statements would it be found?

Answers: 3

You know the right answer?

Mr. Smith, a single taxpayer, died in Year 4. His Year 4 taxable income of $40,000 included the foll...

Questions

Engineering, 21.02.2021 22:30

Chemistry, 21.02.2021 22:30

Mathematics, 21.02.2021 22:30

Business, 21.02.2021 22:30

Mathematics, 21.02.2021 22:30

Biology, 21.02.2021 22:30

English, 21.02.2021 22:30

Mathematics, 21.02.2021 22:30

History, 21.02.2021 22:30

Mathematics, 21.02.2021 22:30

Social Studies, 21.02.2021 22:30

Physics, 21.02.2021 22:30