Business, 20.09.2020 14:01 kittenalexis68

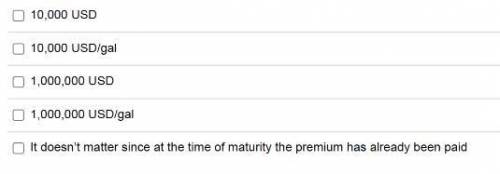

This and the following three questions are related: Suppose that you are a major airline that has budgeted a price of fuel of 1.3840 USD/gal for fiscal year 2021 and you plan to end up buying 1 million gallons of it. To hedge against possible increases in the price you buy a one-year call option with a strike price of 1.4539 USD/gal for 1 million gallons with a premium of 1 cent/gal. How much would you the total premium of the option be

Answers: 1

Another question on Business

Business, 21.06.2019 13:40

Which statement best defines a grant? a grant is an educational plan in which students alternate between studying for school and gaining work experience. a grant is a loan offered to students to pay for education-related expenses. a grant is money given by an organization for a specific purpose. a grant is a loan offered to anyone who is thinking about attending college.

Answers: 1

Business, 21.06.2019 22:30

An annuity that goes on indefinitely is called a perpetuity. the payments of a perpetuity constitute a/an series. the equation is: a stock with no maturity is an example of a perpetuity. quantitative problem: you own a security that provides an annual dividend of $170 forever. the security’s annual return is 9%. what is the present value of this security? round your answer to the nearest cent. $

Answers: 2

Business, 22.06.2019 00:50

Consider each of the following cases: case accounting break-even unit price unit variable cost fixed costs depreciation 1 127,400 $ 38 $ 25 $ 711,000 ? 2 124,000 ? 41 2,500,000 $ 900,000 3 5,753 117 ? 171,000 100,000 required: (a) find the depreciation for case 1. (do not round your intermediate calculations.) (b) find the unit price for case 2. (do not round your intermediate calculations.) (c) find the unit variable cost for case 3. (do not round your intermediate calculations.)

Answers: 2

Business, 22.06.2019 02:00

Benton company (bc), a calendar year entity, has one owner, who is in the 37% federal income tax bracket (any net capital gains or dividends would be taxed at a 20% rate). bc's gross income is $395,000, and its ordinary trade or business deductions are $245,000. ignore the standard deduction (or itemized deductions) and the deduction for qualified business income. if required, round computations to the nearest dollar. a. bc is operated as a proprietorship, and the owner withdraws $100,000 for personal use. bc's taxable income for the current year is $ , and the tax liability associated with the income from the sole proprietorship is $ . b. bc is operated as a c corporation, pays out $100,000 as salary, and pays no dividends to its shareholder. bc's taxable income for the current year is $ , and bc's tax liability is $ . the shareholder's tax liability is $ . c. bc is operated as a c corporation and pays out no salary or dividends to its shareholder. bc's taxable income for the current year is $ , and bc's tax liability is $ . d. bc is operated as a c corporation, pays out $100,000 as salary, and pays out the remainder of its earnings as dividends. bc's taxable income for the current year is $ , and bc's tax liability is $ .

Answers: 2

You know the right answer?

This and the following three questions are related: Suppose that you are a major airline that has bu...

Questions

Chemistry, 23.06.2019 03:00

English, 23.06.2019 03:00

Social Studies, 23.06.2019 03:00

History, 23.06.2019 03:00

Social Studies, 23.06.2019 03:00

History, 23.06.2019 03:00

Mathematics, 23.06.2019 03:00

Chemistry, 23.06.2019 03:00

Physics, 23.06.2019 03:00