Business, 10.09.2020 01:01 juliana211

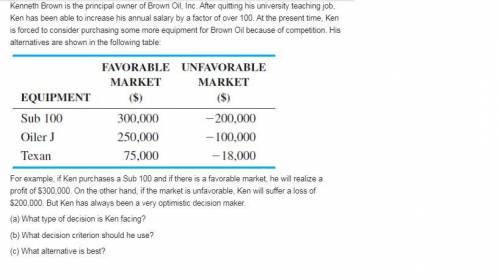

For example, if Ken purchases a Sub 100 and if there is a favorable market, he will realize a profit of $300,000. On the other hand, if the market is unfavorable, Ken will suffer a loss of $200,000. But Ken has always been a very optimistic decision maker. What type of decision is Ken facing

Answers: 3

Another question on Business

Business, 22.06.2019 13:40

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $155,000 of business income from wcc for the year. jacob’s marginal income tax rate is 37 percent. the business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional medicare tax. (round your intermediate calculations to the nearest whole dollar a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

Business, 22.06.2019 18:00

Rosie and her brother michael decided recently to purchase an rv together. they both want to use the rv to take their families camping. the price of the rv was $10,000. since michael expects to use the rv 60% of the time and rosie 40% of the time, michael contributed $6,000 and rosie contributed $4,000. their ownership percentage equals their contribution percentage. which type of property titling should they use to reflect their ownership interest?

Answers: 1

Business, 22.06.2019 19:00

The east asiatic company (eac), a danish company with subsidiaries throughout asia, has been funding its bangkok subsidiary primarily with u.s. dollar debt because of the cost and availability of dollar capital as opposed to thai baht-denominated (b) debt. the treasurer of eac-thailand is considering a 1-year bank loan for $247,000.the current spot rate is b32.03 /$, and the dollar-based interest is 6.78% for the 1-year period. 1-year loans are 12.04% in baht.a. assuming expected inflation rates of 4.3 % and 1.24% in thailand and the united states, respectively, for the coming year, according to purchase power parity, what would the effective cost of funds be in thai baht terms? b. if eac's foreign exchange advisers believe strongly that the thai government wants to push the value of the baht down against the dollar by5% over the coming year (to promote its export competitiveness in dollar markets), what might the effective cost of funds end up being in baht terms? c. if eac could borrow thai baht at 13% per annum, would this be cheaper than either part (a) or part (b) above?

Answers: 2

Business, 22.06.2019 19:30

John's pizzeria and equilibrium john is selling his pizza for $6 per slice in an area of high demand. however, customers are not buying his pizza. using what you learned about the principles of equilibrium, write three to four sentences about how john could solve his problem.

Answers: 1

You know the right answer?

For example, if Ken purchases a Sub 100 and if there is a favorable market, he will realize a profit...

Questions

Physics, 10.12.2019 11:31

Biology, 10.12.2019 11:31

Mathematics, 10.12.2019 11:31

Physics, 10.12.2019 11:31

Mathematics, 10.12.2019 11:31

Biology, 10.12.2019 11:31