Business, 03.09.2020 01:01 chaycebell74021

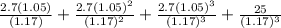

Davenport Corporation's last dividend was $2.70, and the directors expect to maintain the historic 3% annual rate of growth. You plan to purchase the stock today because you feel that the growth rate will increase to 5% for the next three years and the stock will then reach $25 per share.1. How much should you be willing to pay for the stock if you require a 17% return? 2. How much should you be willing to pay for the stock if yo feel that the 5% growth rate can be maintained indefinitely and you require a 17% return?

Answers: 2

Another question on Business

Business, 21.06.2019 18:00

Employers hiring for entry-level positions in hospitality and tourism expect workers to

Answers: 3

Business, 22.06.2019 11:20

Ardmore farm and seed has an inventory dilemma. they have been selling a brand of very popular insect spray for the past year. they have never really analyzed the costs incurred from ordering and holding the inventory and currently fave a large stock of the insecticide in the warehouse. they estimate that it costs $25 to place an order, and it costs $0.25 per gallon to hold the spray. the annual requirements total 80,000 gallons for a 365 day year.a. assuming that 10,000 gallons are ordered each time an order is placed, estimate the annual inventory costs.b. calculate the eoq.c. given the eoq calculated in part b., how many orders should be placed and what is the average inventory balance? d. if it takes seven days to receive an order from suppliers, at what inventory level should ardmore place another order?

Answers: 2

Business, 22.06.2019 12:50

Two products, qi and vh, emerge from a joint process. product qi has been allocated $34,300 of the total joint costs of $55,000. a total of 2,900 units of product qi are produced from the joint process. product qi can be sold at the split-off point for $11 per unit, or it can be processed further for an additional total cost of $10,900 and then sold for $13 per unit. if product qi is processed further and sold, what would be the financial advantage (disadvantage) for the company compared with sale in its unprocessed form directly after the split-off point?

Answers: 2

Business, 22.06.2019 18:00

Your subscription to investing wisely weekly is about to expire. you plan to subscribe to the magazine for the rest of your life, and you can renew it by paying $85 annually, beginning immediately, or you can get a lifetime subscription for $620, also payable immediately. assuming that you can earn 6.0% on your funds and that the annual renewal rate will remain constant, how many years must you live to make the lifetime subscription the better buy?

Answers: 2

You know the right answer?

Davenport Corporation's last dividend was $2.70, and the directors expect to maintain the historic 3...

Questions

Mathematics, 09.10.2021 14:00

Mathematics, 09.10.2021 14:00

Chemistry, 09.10.2021 14:00

Mathematics, 09.10.2021 14:00

Spanish, 09.10.2021 14:00

Mathematics, 09.10.2021 14:00

SAT, 09.10.2021 14:00

Geography, 09.10.2021 14:00

Mathematics, 09.10.2021 14:00

Mathematics, 09.10.2021 14:00

Mathematics, 09.10.2021 14:00

Biology, 09.10.2021 14:00

History, 09.10.2021 14:00

Mathematics, 09.10.2021 14:00