Business, 31.08.2020 01:01 carlyfaith3375

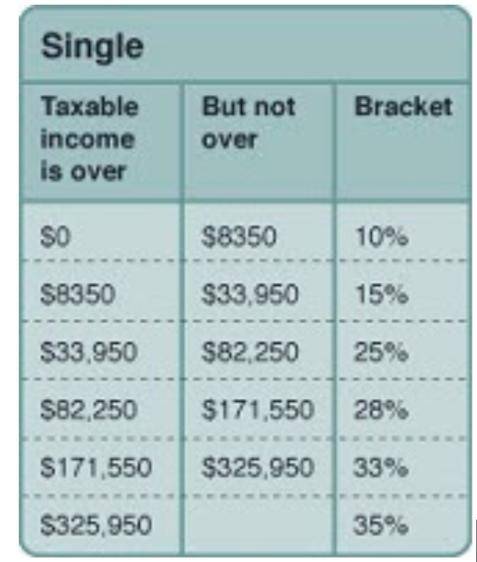

Lewis is single, and he is trying to decide whether to contribute $5000 to a traditional IRA or to a Roth IRA. His taxable income is currently $94,000 per year, and he expects it to be $190,000 per year when he takes his money out of his IRA. He also expects his $5000 investment to triple in value by the time he takes his money out. Use this information and the tax table below to assist Lewis in making his decision. Assume that current tax brackets will stay the same by the time Lewis takes his money out of his IRA

Part I: If Lewis chooses a traditional IRA, how much will he pay in taxes now on the $5000?

Part II: If Lewis chooses a traditional IRA, how much will he pay in taxes when he takes the $5000 and the earnings on the $5000 out of his IRA?

Part III: If Lewis chooses a Roth IRA, how much will he pay in taxes now on the $5000?

Part IV: If Lewis chooses a Roth IRA, how much will he pay in taxes when he takes the $5000 and the earnings on the $5000 out of his IRA?

Part V: Will choosing a traditional IRA or a Roth IRA cause Lewis to pay more in taxes? How much more will Lewis pay?

Answers: 1

Another question on Business

Business, 21.06.2019 23:00

How supply and demand work together to reach the equilibrium price in the marketplace? give at least a paragraph. you!

Answers: 3

Business, 22.06.2019 20:00

If an investment has 35 percent more nondiversifiable risk than the market portfolio, its beta will be:

Answers: 1

Business, 23.06.2019 00:30

Suppose the government decides to issue a new savings bond that is guaranteed to double in value if you hold it for 20 years. assume you purchase a bond that costs $25. a. what is the exact rate of return you would earn if you held the bond for 20 years until it doubled in value? (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. if you purchased the bond for $25 in 2017 at the then current interest rate of .27 percent year, how much would the bond be worth in 2027? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. in 2027, instead of cashing in the bond for its then current value, you decide to hold the bond until it doubles in face value in 2037. what annual rate of return will you earn over the last 10 years? (do not

Answers: 3

Business, 23.06.2019 00:30

Activity-based costing (abc) is not truly a cost collection mechanism as much as it is an inventory valuation method. the main purpose for implementing an activity-based cost system is to try to overcome some of the cost distortions that occur in traditional costing from product differences when there are variations in size and complexity. however, one of the disadvantages of utilizing abc is that the additional information gathering necessary to implement costing with that level of detail might be beyond the reach of some companies with resource or financial constraints. with this in mind, what kinds of industries or companies do you think would benefit most from using activity-based costing and why? in designing or modifying an accounting system to capture appropriate costs for abc, what considerations do you think would need to be made?

Answers: 3

You know the right answer?

Lewis is single, and he is trying to decide whether to contribute $5000 to a traditional IRA or to a...

Questions

Mathematics, 14.12.2019 07:31

Physics, 14.12.2019 07:31

Mathematics, 14.12.2019 07:31

History, 14.12.2019 07:31

Chemistry, 14.12.2019 07:31

Biology, 14.12.2019 07:31

Biology, 14.12.2019 07:31

Mathematics, 14.12.2019 07:31

English, 14.12.2019 07:31