You manage a risky portfolio with an expected rate of return of 18% and a standard deviation of 28%. The T-bill rate is 8%.

A. Your client chooses to invest 70% of a portfolio in you fund and 30% in an essentially risk-free money market fund. What is the expected value and standard deviation of the rate of return on his portfolio?

B. Suppose that your risky portfolio includes the following investments in the given proportions:

Stock A 25%

Stock B 32%

Stock C 43%

What are the investment proportions of your client's overall portfolio, including the position in T-bills?

C. What is the reward-to-volatility (Sharpe) ratio (S) of you risky portfolio? Your clients?

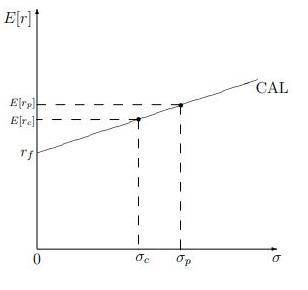

D. Draw the CAL of your portfolio on an expected return-standard deviation diagrm. What is the slop of the CAL? Show the position of your client on your fund's CAL.

Answers: 2

Another question on Business

Business, 22.06.2019 02:30

The dollar value generated over decades of customer loyalty to your company is known as brand equity. viability. sustainability. luck.

Answers: 1

Business, 22.06.2019 03:00

If you were running a company, what are at least two things you could do to improve its productivity.

Answers: 1

Business, 22.06.2019 11:30

On average, someone with a bachelor's degree is estimated to earn times more than someone with a high school diploma. a)1.2 b)1.4 c)1.6 d)1.8

Answers: 1

Business, 22.06.2019 16:30

Why is investing in a mutual fund less risky than investing in a particular company’s stock?

Answers: 3

You know the right answer?

You manage a risky portfolio with an expected rate of return of 18% and a standard deviation of 28%....

Questions

Mathematics, 18.03.2021 02:40

English, 18.03.2021 02:40

English, 18.03.2021 02:40

English, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

Social Studies, 18.03.2021 02:40

History, 18.03.2021 02:40

Mathematics, 18.03.2021 02:40

Computers and Technology, 18.03.2021 02:40

Health, 18.03.2021 02:40

History, 18.03.2021 02:40