Business, 16.08.2020 01:01 valenzueladomipay09u

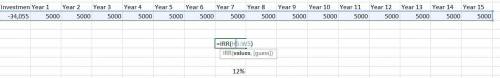

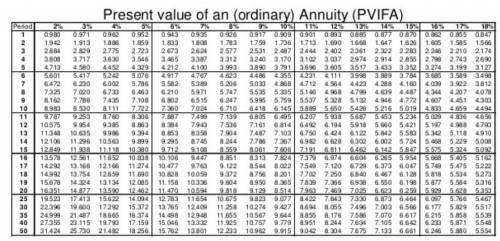

The following data pertain to an investment project (Ignore income taxes.): Investment required $ 34,055 Annual savings $5,000 Life of the project 15 years Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. The internal rate of return is closest to:

Answers: 2

Another question on Business

Business, 22.06.2019 08:00

Lavage rapide is a canadian company that owns and operates a large automatic car wash facility near montreal. the following table provides data concerning the company’s costs: fixed cost per month cost per car washed cleaning supplies $ 0.70 electricity $ 1,400 $ 0.07 maintenance $ 0.15 wages and salaries $ 4,900 $ 0.30 depreciation $ 8,300 rent $ 1,900 administrative expenses $ 1,400 $ 0.03 for example, electricity costs are $1,400 per month plus $0.07 per car washed. the company expects to wash 8,000 cars in august and to collect an average of $6.50 per car washed. the actual operating results for august appear below. lavage rapide income statement for the month ended august 31 actual cars washed 8,100 revenue $ 54,100 expenses: cleaning supplies 6,100 electricity 1,930 maintenance 1,440 wages and salaries 7,660 depreciation 8,300 rent 2,100 administrative expenses 1,540 total expense 29,070 net operating income $ 25,030 required: calculate the company's revenue and spending variances for august.

Answers: 3

Business, 22.06.2019 11:20

Camilo is a self-employed roofer. he reported a profit of $30,000 on his schedule c. he had other taxable income of $5,000. he paid $3,000 for hospitalization insurance. his self-employment tax was $4,656. he paid his former wife $4,000 in court-ordered alimony and $4,000 in child support. what is the amount camilo can deduct in arriving at adjusted gross income (agi)?

Answers: 2

Business, 22.06.2019 13:40

The cook corporation has two divisions--east and west. the divisions have the following revenues and expenses: east west sales $ 603,000 $ 506,000 variable costs 231,000 300,000 traceable fixed costs 151,500 192,000 allocated common corporate costs 128,600 156,000 net operating income (loss) $ 91,900 $ (142,000 ) the management of cook is considering the elimination of the west division. if the west division were eliminated, its traceable fixed costs could be avoided. total common corporate costs would be unaffected by this decision. given these data, the elimination of the west division would result in an overall company net operating income (loss)

Answers: 1

Business, 22.06.2019 20:50

How has apple been able to sustain its competitive advantage in the smartphone industry? a. by reducing its network effects b. by targeting its new products and services toward laggards c. by driving the price for the end user to zero d. by regularly introducing incremental improvements in its products

Answers: 1

You know the right answer?

The following data pertain to an investment project (Ignore income taxes.): Investment required $ 34...

Questions

Mathematics, 06.11.2021 07:40

Chemistry, 06.11.2021 07:40

SAT, 06.11.2021 07:40

Social Studies, 06.11.2021 07:40

Biology, 06.11.2021 07:40

Mathematics, 06.11.2021 07:40

Mathematics, 06.11.2021 07:40

Geography, 06.11.2021 07:40

English, 06.11.2021 07:40

Mathematics, 06.11.2021 07:40