Business, 16.08.2020 01:01 lovenot1977

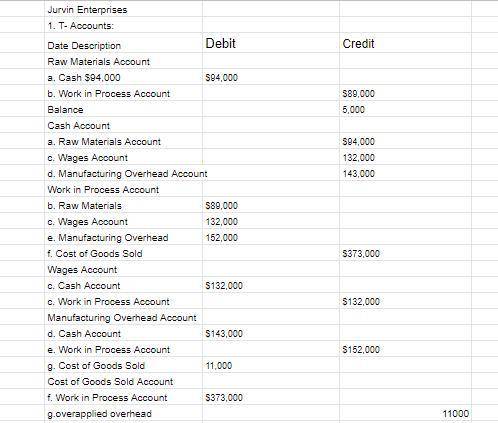

Jurvin Enterprises recorded the following transactions for the just completed month. The company had no beginning inventories. a.$94,000 in raw materials were purchased for cash. b.$89,000 in raw materials were requisitioned for use in production. Of this amount, $78,000 was for direct materials and the remainder was for indirect materials. c.Total labor wages of $132,000 were incurred and paid. Of this amount, $112,000 was for direct labor and the remainder was for indirect labor. d.Additional manufacturing overhead costs of $143,000 were incurred and paid. e.Manufacturing overhead costs of $152,000 were applied to jobs using the company’s predetermined overhead rate. f.All of the jobs in progress at the end of the month were completed and shipped to customers. g.Any underapplied or overapplied overhead for the period was closed out to Cost of Goods Sold.

Answers: 3

Another question on Business

Business, 22.06.2019 21:30

An allergy products superstore buys 6000 of their most popular model of air filters each year. the price of the air filters is $18. the cost of ordering and receiving shipments is $12 per order. accounting estimates annual carrying costs are 20% of the price. the supplier lead time is 2 days. the store operates 240 days per year. each order is received from the supplier in a single delivery. there are no quantity discounts. what is the store’s minimum total annual cost of placing orders & carrying inventory?

Answers: 1

Business, 22.06.2019 22:00

Suppose that with a budget of $110, deborah spends $66 on sushi and $44 on bagels when sushi costs $2 per piece and bagels cost $2 per bagel. but then, the price of bagels falls to $1 per bagel.

Answers: 3

Business, 23.06.2019 01:00

The huntington boys and girls club is conducting a fundraiser by selling chili dinners to go. the price is $7 for an adult meal and $4 for a child’s meal. write a program that accepts the number of adult meals ordered and then children's meals ordered. display the total money collected for adult meals, children’s meals, and all meals.

Answers: 2

Business, 23.06.2019 02:30

Interview notes mike is 50 and made $36,000 in wages in 2017. he is single and pays all the cost of keeping up his home. mike's daughter, brittany, lived with mike all year. brittany's son, hayden, was born in november 2017. hayden lived in mike's home since birth. brittany is 25, single, and had $1,500 in wages in 2017. she is not disabled. mike provides more than half of the support for both brittany and hayden. mike, brittany, and hayden are all u.s. citizens with valid social security numbers. 4. who can mike claim as a qualifying child(ren) for the earned income credit?

Answers: 1

You know the right answer?

Jurvin Enterprises recorded the following transactions for the just completed month. The company had...

Questions

English, 14.10.2020 01:01

English, 14.10.2020 01:01

Mathematics, 14.10.2020 01:01

Mathematics, 14.10.2020 01:01

Mathematics, 14.10.2020 01:01

Mathematics, 14.10.2020 01:01

Mathematics, 14.10.2020 01:01

Mathematics, 14.10.2020 01:01

Social Studies, 14.10.2020 01:01

Biology, 14.10.2020 01:01