Answers: 2

Another question on Business

Business, 22.06.2019 02:00

What is an example of a good stock to buy in a recession? a) cyclical stock b) defensive stock c) income stock d) bond

Answers: 1

Business, 22.06.2019 08:00

Suppose that xtel currently is selling at $40 per share. you buy 500 shares using $15,000 of your own money, borrowing the remainder of the purchase price from your broker. the rate on the margin loan is 8%. a. what is the percentage increase in the net worth of your brokerage account if the price of xtel immediately changes to (a) $44; (b) $40; (c) $36? (leave no cells blank - be certain to enter "0" wherever required. negative values should be indicated by a minus sign. round your answers to 2 decimal places.) b. if the maintenance margin is 25%, how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.) c. how would your answer to requirement 2 would change if you had financed the initial purchase with only $10,000 of your own money? (round your answer to 2 decimal places.) d. what is the rate of return on your margined position (assuming again that you invest $15,000 of your own money) if xtel is selling after one year at (a) $44; (b) $40; (c) $36? (negative values should be indicated by a minus sign. round your answers to 2 decimal places.) e. continue to assume that a year has passed. how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.)

Answers: 1

Business, 22.06.2019 15:20

Kelso electric is debating between a leveraged and an unleveraged capital structure. the all equity capital structure would consist of 40,000 shares of stock. the debt and equity option would consist of 25,000 shares of stock plus $280,000 of debt with an interest rate of 7 percent. what is the break-even level of earnings before interest and taxes between these two options?

Answers: 2

Business, 22.06.2019 21:50

scenario: hawaii and south carolina are trading partners. hawaii has an absolute advantage in the production of both coffee and tea. the opportunity cost of producing 1 pound of tea in hawaii is 2 pounds of coffee, and the opportunity cost of producing 1 pound of tea in south carolina is 1/3 pound of coffee. which of the following statements is true? a. south carolina should specialize in the production of both tea and coffee. b. hawaii should specialize in the production of tea, whereas south carolina should specialize in the production of coffee. c. hawaii should specialize in the production of coffee, whereas south carolina should specialize in the production of tea. d. hawaii should specialize in the production of both tea and coffee.

Answers: 1

You know the right answer?

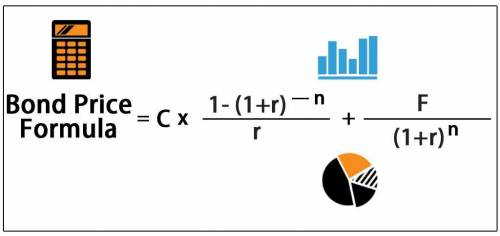

Gabriele Enterprises has bonds on the market making annual payments, with 18 years to maturity, a pa...

Questions

Mathematics, 24.09.2020 21:01

Mathematics, 24.09.2020 21:01

Mathematics, 24.09.2020 21:01

Mathematics, 24.09.2020 21:01

English, 24.09.2020 21:01

English, 24.09.2020 21:01

Mathematics, 24.09.2020 21:01

Mathematics, 24.09.2020 21:01