Business, 12.08.2020 06:01 teasleycarl53

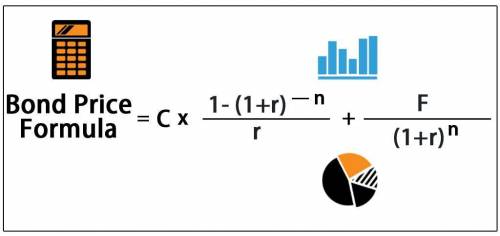

consider a bond that matures in 10 years it pay9% annual coupons and $100 at maturity is the required annual rate of return on the bond i s 8% then the bond will sell today for

Answers: 2

Another question on Business

Business, 22.06.2019 10:10

Rats that received electric shocks were unlikely to develop ulcers if the

Answers: 1

Business, 22.06.2019 10:30

On july 1, oura corp. made a sale of $ 450,000 to stratus, inc. on account. terms of the sale were 2/10, n/30. stratus makes payment on july 9. oura uses the net method when accounting for sales discounts. ignore cost of goods sold and the reduction of inventory. a. prepare all oura's journal entries. b. what net sales does oura report?

Answers: 2

Business, 22.06.2019 10:30

When sending a claim to an insurance company for services provided by the physician, why are both icd-10 and cpt codes required to be submitted? how are these codes dependent upon each other? what would be the result of not submitting both codes on a medical claim to an insurance company?

Answers: 2

You know the right answer?

consider a bond that matures in 10 years it pay9% annual coupons and $100 at maturity is the require...

Questions

English, 19.05.2021 23:40

Mathematics, 19.05.2021 23:40

English, 19.05.2021 23:40

Mathematics, 19.05.2021 23:40

Mathematics, 19.05.2021 23:40

Biology, 19.05.2021 23:40

Mathematics, 19.05.2021 23:40

Mathematics, 19.05.2021 23:40

Mathematics, 19.05.2021 23:40

Mathematics, 19.05.2021 23:40

Mathematics, 19.05.2021 23:40

Mathematics, 19.05.2021 23:40

Mathematics, 19.05.2021 23:40