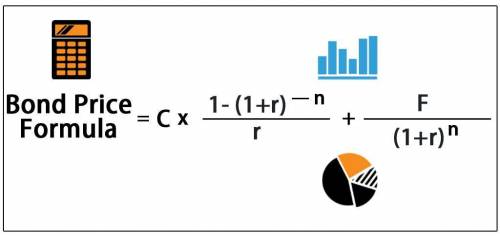

Bob is evaluating a bond issue to determine the right price for the bond. In his evaluation, he gathers the following information:

N = 8 years INT = .025 or 2.5% PMT = $25 FV = $1,000 (par value)

What is the above bond issue worth in today's dollars?

a. $1,000

b. $1,181.63

c. $1,200.50

d. None of the above

Answers: 1

Another question on Business

Business, 22.06.2019 11:50

What is marketing’s contribution to the new product development team? a. technical expertise needed to translate designs into an actual product/service. b. deep customer insight that leads to product ideas. c. ability to assess financial viability d. feedback on design as well as how customers will actually use the product e. technical expertise needed to translate concepts into product/service designs.

Answers: 2

Business, 22.06.2019 18:30

Hilary works at klothes kloset. she quickly the customers, and her cash drawer is always correct at the end of her shift. however, she never tries to "upsell" the customers (for example, by asking if they would like to purchase earrings to go with the shirt they chose or by suggesting a purse that matches the shoes they are buying). give hilary some constructive feedback on her performance.

Answers: 3

Business, 22.06.2019 19:50

Managers in a firm hired to improve the firm's profitability and ultimately the shareholders' value will add to the overall costs if they pursue their own self-interests. what does this best illustrate? a. diseconomies of scale b. principal-agent problem c. experience-curveeffects d. information asymmetries

Answers: 1

Business, 22.06.2019 20:20

Carmen’s beauty salon has estimated monthly financing requirements for the next six months as follows: january $ 9,000 april $ 9,000 february 3,000 may 10,000 march 4,000 june 5,000 short-term financing will be utilized for the next six months. projected annual interest rates are: january 9 % april 16 % february 10 may 12 march 13 june 12 what long-term interest rate would represent a break-even point between using short-term financing and long-term financing?

Answers: 3

You know the right answer?

Bob is evaluating a bond issue to determine the right price for the bond. In his evaluation, he gath...

Questions

Biology, 16.07.2019 23:00

Mathematics, 16.07.2019 23:00

Mathematics, 16.07.2019 23:00

History, 16.07.2019 23:00

English, 16.07.2019 23:00

Mathematics, 16.07.2019 23:00

Mathematics, 16.07.2019 23:00

Biology, 16.07.2019 23:00

Health, 16.07.2019 23:00

Mathematics, 16.07.2019 23:00

Physics, 16.07.2019 23:00

English, 16.07.2019 23:00