Business, 28.07.2020 19:01 VoidedAngel

The company is considering the purchase of machinery and equipment to set up a line to produce a combination washer-dryer. They have given you the following information to analyze the project on a 5-year timeline:

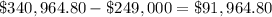

Initial cash outlay is $150,000, no residual value.

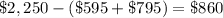

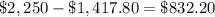

Sales price is expected to be $2,250 per unit, with $595 per unit in labor expense and $795 per unit in materials.

Direct fixed costs are estimated to run $20,750 per month.

Cost of capital is 8%, and the required rate of return is 10%.

They will incur all operational costs in Year 1, though sales are expected to be 55% of break-even.

Break-even (considering only direct fixed costs) is expected to occur in Year 2.

Variable costs will increase 2% each year, starting in Year 3.

Sales are estimated to grow by 10%, 15%, and 20% for years 3 - 5.

Then to calculate:

The product’s contribution margin

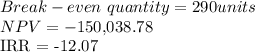

Break-even quantity

NPV

IRR

Finally:

Explain how the project analyses do or do not support this decision.

In either case, what are the factors that should have been considered in management’s decision?

Answers: 1

Another question on Business

Business, 22.06.2019 07:30

An important application of regression analysis in accounting is in the estimation of cost. by collecting data on volume and cost and using the least squares method to develop an estimated regression equation relating volume and cost, an accountant can estimate the cost associated with a particular manufacturing volume. consider the following sample of production volumes and total cost data for a manufacturing operation. production volume (units) total cost ($) 400 4000 450 5000 550 5400 600 5900 700 6400 750 7000 compute b 1 and b 0 (to 2 decimals if necessary). b 1 b 0 complete the estimated regression equation (to 2 decimals if necessary). = + x what is the variable cost per unit produced (to 1 decimal)? $ compute the coefficient of determination (to 4 decimals). note: report r 2 between 0 and 1. r 2 = what percentage of the variation in total cost can be explained by the production volume (to 2 decimals)? % the company's production schedule shows 500 units must be produced next month. what is the estimated total cost for this operation (to 2 decimals)? $

Answers: 1

Business, 22.06.2019 15:10

On december 31, 2013, coronado company issues 173,000 stock-appreciation rights to its officers entitling them to receive cash for the difference between the market price of its stock and a pre-established price of $10. the fair value of the sars is estimated to be $5 per sar on december 31, 2014; $2 on december 31, 2015; $10 on december 31, 2016; and $8 on december 31, 2017. the service period is 4 years, and the exercise period is 7 years. prepare a schedule that shows the amount of compensation expense allocable to each year affected by the stock-appreciation rights plan.

Answers: 2

Business, 22.06.2019 17:30

Communication comes in various forms. which of the following is considered an old form of communication? a) e-mail b) letter c) skype d) texting

Answers: 2

Business, 22.06.2019 19:40

You estimate that your cattle farm will generate $0.15 million of profits on sales of $3 million under normal economic conditions and that the degree of operating leverage is 2. (leave no cells blank - be certain to enter "0" wherever required. do not round intermediate calculations. enter your answers in millions.) a. what will profits be if sales turn out to be $1.5 million?

Answers: 3

You know the right answer?

The company is considering the purchase of machinery and equipment to set up a line to produce a com...

Questions

Mathematics, 13.01.2021 20:10

Physics, 13.01.2021 20:10

History, 13.01.2021 20:10

Mathematics, 13.01.2021 20:10

Arts, 13.01.2021 20:10

Mathematics, 13.01.2021 20:10

Business, 13.01.2021 20:10

Mathematics, 13.01.2021 20:10

Mathematics, 13.01.2021 20:10

Selling price per unit

Selling price per unit  Labor

Labor  Materials

Materials  Total fixed costs

Total fixed costs

Contribution margin year 3:

Contribution margin year 3:  Contribution margin year 4:

Contribution margin year 4:  Contribution margin year 5:

Contribution margin year 5:

Sales during year 2:

Sales during year 2:  Sales during year 3:

Sales during year 3:  Sales during year 4:

Sales during year 4:  Sales during year 5:

Sales during year 5:

Net cash flow year 2:

Net cash flow year 2:  Net cash flow year 3:

Net cash flow year 3:  Net cash flow year 4:

Net cash flow year 4:  Net cash flow year 5:

Net cash flow year 5: