Business, 19.07.2020 14:01 lflugo6oyn4sp

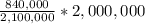

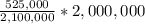

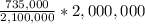

Pinewood Company purchased two buildings on four acres of land. The lump-sum purchase price was $2,000,000. According to independent appraisals, the fair values were $840,000 (building A) and $525,000 (building B) for the buildings and $735,000 for the land. Required: Determine the initial valuation of the buildings and the land.

Asset Initial Valuation

Land

Building A

Building B

Total

Answers: 1

Another question on Business

Business, 22.06.2019 06:00

Why might a business based on a fad be a good idea? question 2 options: fads bring in the most customers. some fads are longer lasting than expected. fads have made some business owners incredibly wealthy. fads can take a business in a new direction.

Answers: 2

Business, 22.06.2019 07:30

Select the correct answer the smith family adopted a child. the adoption procedure took about three months, and the family incurred various expenses. will the smiths receive and financial benefit for the taxable year? a) they will not receive any financial benefit for adopting the child b) their income tax component will decrease c) they will receive childcare grants d) they will receive a tax credit for the cost borne for adopting the child e) they will receive several tax deductions

Answers: 3

Business, 22.06.2019 08:30

Match each item to check for while reconciling a bank account with the document to which it relates.(there's not just one answer)1. balancing account statement2. balancing check registera. nsf feesb. deposits in transitc. interest earnedd. bank errors

Answers: 2

Business, 22.06.2019 14:40

Which of the following would classify as a general education requirement

Answers: 1

You know the right answer?

Pinewood Company purchased two buildings on four acres of land. The lump-sum purchase price was $2,0...

Questions

Geography, 06.11.2020 02:50

History, 06.11.2020 02:50

English, 06.11.2020 02:50

Mathematics, 06.11.2020 02:50

Mathematics, 06.11.2020 02:50

Mathematics, 06.11.2020 02:50

Social Studies, 06.11.2020 02:50

Mathematics, 06.11.2020 02:50

Medicine, 06.11.2020 02:50