Answers: 3

Another question on Business

Business, 21.06.2019 21:30

Price and efficiency variances, journal entries. the schuyler corporation manufactures lamps. it has set up the following standards per finished unit for direct materials and direct manufacturing labor: direct materials: 10 lb. at $4.50 per lb. $45.00 direct manufacturing labor: 0.5 hour at $30 per hour 15.00 the number of finished units budgeted for january 2017 was 10,000; 9,850 units were actually produced. actual results in january 2017 were as follows: direct materials: 98,055 lb. used direct manufacturing labor: 4,900 hours $154,350 assume that there was no beginning inventory of either direct materials or finished units. during the month, materials purchased amounted to 100,000 lb., at a total cost of $465,000. input price variances are isolated upon purchase. input-efficiency variances are isolated at the time of usage. 1. compute the january 2017 price and efficiency variances of direct materials and direct manufacturing labor. 2. prepare journal entries to record the variances in requirement 1. 3. comment on the january 2017 price and efficiency variances of schuyler corporation. 4. why might schuyler calculate direct materials price variances and direct materials efficiency variances with reference to different points in time

Answers: 2

Business, 22.06.2019 08:40

Examine the following book-value balance sheet for university products inc. the preferred stock currently sells for $30 per share and pays a dividend of $3 a share. the common stock sells for $16 per share and has a beta of 0.9. there are 2 million common shares outstanding. the market risk premium is 9%, the risk-free rate is 5%, and the firm’s tax rate is 40%. book-value balance sheet (figures in $ millions) assets liabilities and net worth cash and short-term securities $ 2.0 bonds, coupon = 6%, paid annually (maturity = 10 years, current yield to maturity = 8%) $ 5.0 accounts receivable 3.0 preferred stock (par value $15 per share) 3.0 inventories 7.0 common stock (par value $0.20) 0.4 plant and equipment 21.0 additional paid-in stockholders’ equity 13.6 retained earnings 11.0 total $ 33.0 total $ 33.0 a. what is the market debt-to-value ratio of the firm? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.) b. what is university’s wacc? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.)

Answers: 3

Business, 22.06.2019 15:20

Garfield corporation is considering building a new plant in canada. it predicts sales at the new plant to be 50,000 units at $5.00/unit. below is a listing of estimated expenses. category total annual expenses % of annual expense that are fixed materials $50,000 10% labor $90,000 20% overhead $40,000 30% marketing/admin $20,000 50% a canadian firm was contracted to sell the product and will receive a commission of 10% of the sales price. no u.s. home office expenses will be allocated to the new facility. the contribution margin ratio for garfield corporation is

Answers: 2

Business, 22.06.2019 19:00

The following are budgeted data: january february march sales in units 16,200 22,400 19,200 production in units 19,200 20,200 18,700 one pound of material is required for each finished unit. the inventory of materials at the end of each month should equal 20% of the following month's production needs. purchases of raw materials for february would be budgeted to be:

Answers: 3

You know the right answer?

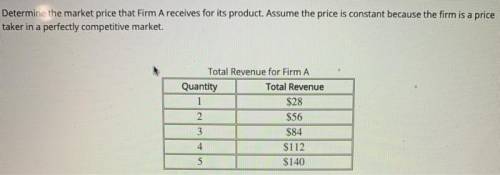

Determine the market price that Firm A receives for its product. Assume the price is constant becaus...

Questions

Mathematics, 08.03.2021 22:20

Mathematics, 08.03.2021 22:20

Mathematics, 08.03.2021 22:20

Mathematics, 08.03.2021 22:20

Mathematics, 08.03.2021 22:20

Chemistry, 08.03.2021 22:20

Mathematics, 08.03.2021 22:20

Computers and Technology, 08.03.2021 22:20

Mathematics, 08.03.2021 22:20

Mathematics, 08.03.2021 22:20

Mathematics, 08.03.2021 22:20