Business, 17.07.2020 01:01 rebekah1503

A company manufactures two products. For $1.00 worth of product A, the company spends $0.40 on materials, $0.20 on labor, and $0.10 on overhead. For $1.00 worth of product B, the company spends $0.50 on materials, $0.20 on labor, and $0.15 on overhead.

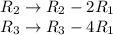

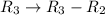

Let

a = (0.40, 0.20, 0.10) b = (0.50, 0.20, 0.15)

Then a and b represent the "costs per dollar of income" for the two products. Suppose the company manufactures x dollars worth of product A and y dollars worth of product B and that its total costs for materials are $260, its total costs for labor are $120, and its total costs for overhead are $70.

Determine x and y, the dollars worth of each product produced.

Answers: 3

Another question on Business

Business, 23.06.2019 01:30

Brian has just finished college. he wants to set up a small business to make and sell fireworks. he registers his company and acquires a license from the government. he finds that most of his competitors are selling fireworks at an extremely low price. he would like to make more money, so he decides to innovate and develop better fireworks. he sells his fireworks at a higher price, and they are a huge hit with the customers. after a few years, he earns enough profit to set up a bigger fireworks factory that complies with the government’s health and safety regulations. he even starts exporting fireworks overseas. which type of economy does this scenario describe?

Answers: 3

Business, 23.06.2019 02:20

Kubin company’s relevant range of production is 18,000 to 22,000 units. when it produces and sells 20,000 units, its average costs per unit are as follows: average cost per unit direct materials $ 7.00 direct labor $ 4.00 variable manufacturing overhead $ 1.50 fixed manufacturing overhead $ 5.00 fixed selling expense $ 3.50 fixed administrative expense $ 2.50 sales commissions $ 1.00 variable administrative expense $ 0.50 required: 1. for financial accounting purposes, what is the total amount of product costs incurred to make 20,000 units? 2. for financial accounting purposes, what is the total amount of period costs incurred to sell 20,000 units? 3. for financial accounting purposes, what is the total amount of product costs incurred to make 22,000 units? 4. for financial accounting purposes, what is the total amount of period costs incurred to sell 18,000 units?

Answers: 1

Business, 23.06.2019 09:40

What is an example of a functional organizational structure?

Answers: 1

Business, 23.06.2019 15:30

World systems manufactures an optical switch that it uses in its final product. world systems incurred the following manufacturing costs when it produced 74 comma 000 units last​ year: ​(click the icon to view the manufacturing​ costs.) another company has offered to sell world systems the switch for $ 13.50 per unit. the world systems prepared an outsourcing decision analysis to show the cost per unit of making the switches versus the cost per unit of buying​ (outsourcing) the switches. ​(click the icon to view the outsourcing decision​ analysis.) world systems needs 86 comma 000 optical switches next year​ (assume same relevant​ range). by outsourcing​ them, world systems can use its idle facilities to manufacture another product that will contribute $ 140 comma 000 to operating​ income, but none of the fixed costs will be avoidable. should world systems make or buy the​ switches? show your analysis.

Answers: 2

You know the right answer?

A company manufactures two products. For $1.00 worth of product A, the company spends $0.40 on mater...

Questions

Mathematics, 29.06.2019 18:00

Computers and Technology, 29.06.2019 18:00

Mathematics, 29.06.2019 18:00

Mathematics, 29.06.2019 18:00

Mathematics, 29.06.2019 18:00

Biology, 29.06.2019 18:00

Business, 29.06.2019 18:00

Mathematics, 29.06.2019 18:00

Social Studies, 29.06.2019 18:00

![a = \left[\begin{array}{ccc}0.4\\0.2\\0.1\end{array}\right]\\b = \left[\begin{array}{ccc}0.5\\0.2\\0.15\end{array}\right]](/tpl/images/0708/1318/5cdbd.png)

![xa + yb = \left[\begin{array}{ccc}260\\120\\70\end{array}\right] \\x \left[\begin{array}{ccc}0.4\\0.2\\0.1\end{array}\right] + y \left[\begin{array}{ccc}0.5\\0.2\\0.15\end{array}\right] = \left[\begin{array}{ccc}260\\120\\70\end{array}\right]](/tpl/images/0708/1318/281e5.png)

![\left[\begin{array}{ccc}0.4&0.5\\0.2&0.2\\0.1&0.15\end{array}\right] \left[\begin{array}{ccc}x\\y\end{array}\right] = \left[\begin{array}{ccc}260\\120\\70\end{array}\right]\\\\\left[\begin{array}{ccc}0.1&0.15\\0.2&0.2\\0.4&0.5\end{array}\right] \left[\begin{array}{ccc}x\\y\end{array}\right] = \left[\begin{array}{ccc}70\\120\\260\end{array}\right]\\](/tpl/images/0708/1318/e1be4.png)

![\left[\begin{array}{ccc}0.1&0.15\\0&-0.1\\0&-0.1\end{array}\right] \left[\begin{array}{ccc}x\\y\end{array}\right] = \left[\begin{array}{ccc}70\\-20\\-20\end{array}\right]\\](/tpl/images/0708/1318/f13c4.png)

![\left[\begin{array}{ccc}0.1&0.15\\0&-0.1\\0&0\end{array}\right] \left[\begin{array}{ccc}x\\y\end{array}\right] = \left[\begin{array}{ccc}70\\-20\\0\end{array}\right]\\\left[\begin{array}{ccc}0.1&0.15\\0&-0.1\end{array}\right] \left[\begin{array}{ccc}x\\y\end{array}\right] = \left[\begin{array}{ccc}70\\-20\end{array}\right]](/tpl/images/0708/1318/cace9.png)