Business, 16.07.2020 02:01 crispymaddix12

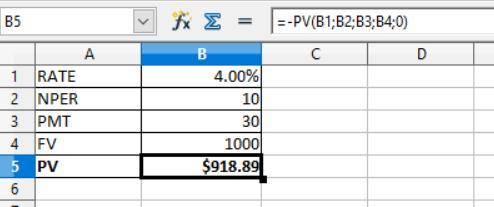

A $1000 par value bond with 5 years to maturity and a 6% coupon has a yield to maturity of 8%. Interest is paid semiannually. Calculate the current price of the bond. Group of answer choices $1579.46 $918.89 $789.29 $1000.00 $743.29

Answers: 1

Another question on Business

Business, 21.06.2019 22:50

Tara incorporates her sole proprietorship, transferring it to newly formed black corporation. the assets transferred have an adjusted basis of $240,000 and a fair market value of $300,000. also transferred was $10,000 in liabilities, $1,000 of which was personal and the balance of $9,000 being business related. in return for these transfers, tara receives all of the stock in black corporation. a. black corporation has a basis of $241,000 in the property. b. black corporation has a basis of $240,000 in the property. c. tara’s basis in the black corporation stock is $241,000. d. tara’s basis in the black corporation stock is $249,000. e. none of the above.

Answers: 1

Business, 22.06.2019 12:30

Sales at a fast-food restaurant average $6,000 per day. the restaurant decided to introduce an advertising campaign to increase daily sales. to determine the effectiveness of the advertising campaign, a sample of 49 days of sales were taken. they found that the average daily sales were $6,300 per day. from past history, the restaurant knew that its population standard deviation is about $1,000. if the level of significance is 0.01, have sales increased as a result of the advertising campaign? multiple choicea)fail to reject the null hypothesis.b)reject the null hypothesis and conclude the mean is higher than $6,000 per day.c)reject the null hypothesis and conclude the mean is lower than $6,000 per day.d)reject the null hypothesis and conclude that the mean is equal to $6,000 per day.expert answer

Answers: 3

Business, 22.06.2019 20:40

On january 1, 2017, pharoah company issued 10-year, $2,020,000 face value, 6% bonds, at par. each $1,000 bond is convertible into 16 shares of pharoah common stock. pharoah’s net income in 2017 was $317,000, and its tax rate was 40%. the company had 97,000 shares of common stock outstanding throughout 2017. none of the bonds were converted in 2017. (a) compute diluted earnings per share for 2017. (round answer to 2 decimal places, e.g. $2.55.) diluted earnings per share

Answers: 3

Business, 23.06.2019 13:30

During a meeting, tammy, a branch manager for usa bank, pointed to the corporate organization chart on the wall. tammy remarked that "these people provide advice, recommendations, and research for us, and they are indicated with a dotted line. laura (our ceo) and the vice presidents of our organization are up here, indicated on the organization chart by a solid line vertical line." are indicated on the organization chart by a solid line and are indicated by a dotted line. a. line managers; temporary personnel b. line managers; personnel in training c. staff personnel; vital personnel d. line managers; part-time personnel e. line managers; staff personnel

Answers: 2

You know the right answer?

A $1000 par value bond with 5 years to maturity and a 6% coupon has a yield to maturity of 8%. Inter...

Questions

Mathematics, 25.11.2019 01:31

History, 25.11.2019 01:31

Mathematics, 25.11.2019 01:31

History, 25.11.2019 01:31

Mathematics, 25.11.2019 01:31

Mathematics, 25.11.2019 01:31

Health, 25.11.2019 01:31

Chemistry, 25.11.2019 01:31