Business, 16.07.2020 01:01 gungamer720

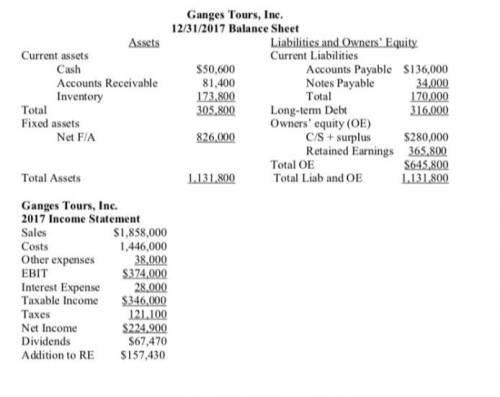

11. Consider the Ganges Tours, Inc. financial statements below. Calculate the following ratios:a. Current ratio. b. Quick ratio. c. Cash ratio. d. Total Debt ratio

Answers: 3

Another question on Business

Business, 22.06.2019 08:00

Shrieves casting company is considering adding a new line to its product mix, and the capital budgeting analysis is being conducted by sidney johnson, a recently graduated mba. the production line would be set up in unused space in the main plant. the machinery’s invoice price would be approximately $200,000, another $10,000 in shipping charges would be required, and it would cost an additional $30,000 to install the equipment. the machinery has an economic life of 4 years, and shrieves has obtained a special tax ruling that places the equipment in the macrs 3-year class. the machinery is expected to have a salvage value of $25,000 after 4 years of use. the new line would generate incremental sales of 1,250 units per year for 4 years at an incremental cost of $100 per unit in the first year, excluding depreciation. each unit can be sold for $200 in the first year. the sales price and cost are both expected to increase by 3% per year due to inflation. further, to handle the new line, the firm’s net working capital would have to increase by an amount equal to 12% of sales revenues. the firm’s tax rate is 40%, and its overall weighted average cost of capital, which is the risk-adjusted cost of capital for an average project (r), is 10%. define “incremental cash flow.” (1) should you subtract interest expense or dividends when calculating project cash flow?

Answers: 1

Business, 22.06.2019 08:30

Which of the following is an example of search costs? a.) driving to a faraway place to find available goods b.) buying goods in some special way that is outside the normal channels c.) paying a premium cost for goods d.) selling extra goods for a discount price

Answers: 1

Business, 22.06.2019 15:20

Capital financial corporation will lend 90 percent against account balances that have averaged 30 days or less; 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. the current prime rate is 16.50 percent, and capital charges 3.50 percent over prime to charming as its annual loan rate. a. determine the maximum loan for which charming paper company could qualify.

Answers: 1

You know the right answer?

11. Consider the Ganges Tours, Inc. financial statements below. Calculate the following ratios:a. Cu...

Questions

Social Studies, 12.10.2020 22:01

Mathematics, 12.10.2020 22:01

Mathematics, 12.10.2020 22:01

Social Studies, 12.10.2020 22:01

Chemistry, 12.10.2020 22:01

Mathematics, 12.10.2020 22:01

Mathematics, 12.10.2020 22:01

Mathematics, 12.10.2020 22:01

Computers and Technology, 12.10.2020 22:01

Mathematics, 12.10.2020 22:01

World Languages, 12.10.2020 22:01

Mathematics, 12.10.2020 22:01