Business, 15.07.2020 01:01 Randomkid0973

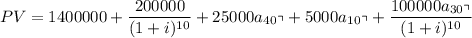

The city of Modesto, California needs more water. The town engineer has selected two plans for comparison: a gravity-based plan (divert water from the Sierras and pipe it by gravity to the city) and a pumping plan (pump water from a closer water source to the city). The pumping plant would be built in two stages, with half-capacity installed initially and the other half installed 10 years later. The analysis should assume a 40-year life, 10% interest on the municipal loan used to finance the project, and no salvage value of the project or equipment and the end of its life. Gravity Pumping Initial investment $2.8 million $1.4 millionAdditional investment in year 10 None $200,000Operation and maintenance $10,000/yr $25,000/yr Power cost Average the first 10 years None $50,000/yr Average the next 30 years None $100,000/yr(a) Use an annual cash flow analysis to find out which plan is preferred(b) What is the breakeven investment cost in year 10 to make these two projects equally preferable?

Answers: 3

Another question on Business

Business, 22.06.2019 07:30

An instance where sellers should work to keep relationships with customers is when they instance where selllars should work to keep relationships with customers is when they feel that the product

Answers: 1

Business, 22.06.2019 11:30

(select all that apply) examples of email use that could be considered unethical include denying receiving an e-mail requesting that you work late forwarding a chain letter asking for donations to a good cause sending a quick message to your friend about last weekend sending your boss the monthly sales figures in an attachment setting up a meeting with your co-worker sharing a funny joke with other employees

Answers: 2

Business, 22.06.2019 15:20

Martinez company has the following two temporary differences between its income tax expense and income taxes payable. 2017 2018 2019 pretax financial income $873,000 $866,000 $947,000 (2017' 2018, 2019) excess depreciation expense on tax return (29,400 ) (39,000 ) (9,600 ) (2017' 2018, 2019) excess warranty expense in financial income 20,000 9,900 8,300 (2017' 2018, 2019) taxable income $863,600 $836,900 $945,700(2017' 2018, 2019) the income tax rate for all years is 40%. instructions: a. prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017, 2018, and 2019. b. assuming there were no temporary differences prior to 2016, indicate how deferred taxes will be reported on the 2016 balance sheet. button's warranty is for 12 months. c. prepare the income tax expense section of the income statement for 2017, beginning with the line, "pretax financial income."

Answers: 3

Business, 22.06.2019 17:50

Which of the following is an element of inventory holding costs? a. material handling costs b. investment costs c. housing costs d. pilferage, scrap, and obsolescence e. all of the above are elements of inventory holding costs.

Answers: 1

You know the right answer?

The city of Modesto, California needs more water. The town engineer has selected two plans for compa...

Questions

English, 19.12.2020 01:00

Social Studies, 19.12.2020 01:00

Mathematics, 19.12.2020 01:00

Mathematics, 19.12.2020 01:00

Arts, 19.12.2020 01:00

Arts, 19.12.2020 01:00

Arts, 19.12.2020 01:00

Chemistry, 19.12.2020 01:00

Mathematics, 19.12.2020 01:00

Chemistry, 19.12.2020 01:00

Biology, 19.12.2020 01:00

Mathematics, 19.12.2020 01:00

Mathematics, 19.12.2020 01:00

Mathematics, 19.12.2020 01:00

at 10%

at 10%

at 10%

at 10%