Business, 18.06.2020 15:57 ieshaking28

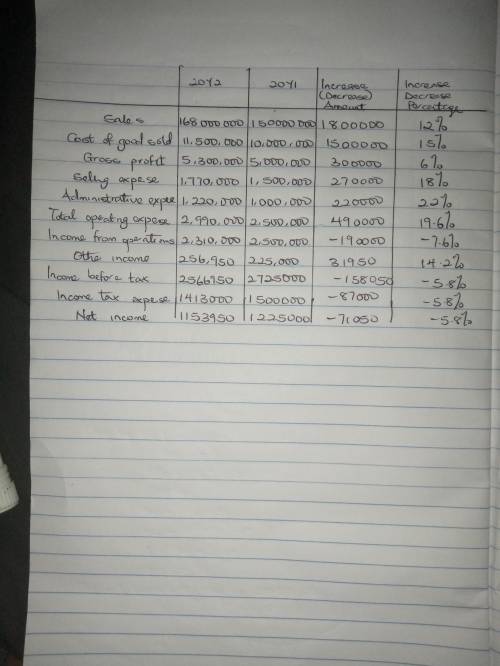

For 20Y2, McDade Company reported a decline in net income. At the end of the year, T. Burrows, the president, is presented with the following condensed comparative income statement:

Question not attempted.

McDade Company

Comparative Income Statement

For the Years Ended December 31, 20Y2 and 20Y1

1 20Y2 20Y1

2 Sales $16,800,000.00 $15,000,000.00

3 Cost of goods sold 11,500,000.00 10,000,000.00

4 Gross profit $5,300,000.00 $5,000,000.00

5 Selling expenses $1,770,000.00 $1,500,000.00

6 Administrative

expenses 1,220,000.00 1,000,000.00

7 Total operating

expenses $2,990,000.00 $2,500,000.00

8 Income from

operations $2,310,000.00 $2,500,000.00

9 Other income 256,950.00 225,000.00

10 Income before

income tax $2,566,950.00 $2,725,000.00

11 Income tax expense 1,413,000.00 1,500,000.00

12 Net income $1,153,950.00 $1,225,000.00

1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 20Y1 as the base year. Use the minus sign to indicate an amount or percent decrease. If required, round percentages to one decimal place.

2. To the extent the data permit, comment on the significant relationships revealed by the horizontal analysis prepared in (1).

Answers: 3

Another question on Business

Business, 22.06.2019 12:50

Required information problem 15-1a production costs computed and recorded; reports prepared lo c2, p1, p2, p3, p4 [the following information applies to the questions displayed below. marcelino co.'s march 31 inventory of raw materials is $84,000. raw materials purchases in april are $540,000, and factory payroll cost in april is $364,000. overhead costs incurred in april are: indirect materials, $59,000; indirect labor, $26,000; factory rent, $38,000; factory utilities, $19,000; and factory equipment depreciation, $58,000. the predetermined overhead rate is 50% of direct labor cost. job 306 is sold for $670,000 cash in april. costs of the three jobs worked on in april follow. job 306 job 307 job 308 balances on march 31 direct materials $30,000 $36,000 direct labor 25,000 14,000 applied overhead 12,500 7,000 costs during april direct materials 133,000 210,000 $100,000 direct labor 105,000 150,000 101,000 applied overhead ? ? ? status on april 30 finished (sold) finished in process (unsold) required: 1. determine the total of each production cost incurred for april (direct labor, direct materials, and applied overhead), and the total cost assigned to each job (including the balances from march 31). a-materials purchases (on credit). b-direct materials used in production. c-direct labor paid and assigned to work in process inventory. d-indirect labor paid and assigned to factory overhead. e-overhead costs applied to work in process inventory. f-actual overhead costs incurred, including indirect materials. (factory rent and utilities are paid in cash.) g-transfer of jobs 306 and 307 to finished goods inventory. h-cost of goods sold for job 306. i-revenue from the sale of job 306. j-assignment of any underapplied or overapplied overhead to the cost of goods sold account. (the amount is not material.) 2. prepare journal entries for the month of april to record the above transactions. 3. prepare a schedule of cost of goods manufactured. 4.1 compute gross profit for april. 4.2 show how to present the inventories on the april 30 balance sheet.

Answers: 3

Business, 22.06.2019 19:10

Robin hood has hired you as his new strategic consultant to him successfully transform his social change enterprise. robin has told you that he counting on your strategic management knowledge to him and his merrymen achieve their goals. discuss in detail what you think should be robin’s two primary strategic goals and continue by also explaining your analytical reasons that support your recommendations.

Answers: 3

Business, 22.06.2019 21:30

Which of the following best explains the purpose of protectionist trade policies such as tariffs and subsidies? a. they make sure that governments have enough money to pay for fiscal policies. b. they give foreign competitors access to new markets around the world. c. they allow producers to sell their products more cheaply than foreign competitors. d. they enable producers to purchase productive resources from everywhere in the world.

Answers: 1

Business, 23.06.2019 12:40

Acompany finances the purchase of equipment with a $500,000 5-year note payable. the note has an interest rate of 12% and a monthly payment of $11,122. after two payments have been made, what amount should the company report as the note payable balance in its december 31 balance sheet?

Answers: 2

You know the right answer?

For 20Y2, McDade Company reported a decline in net income. At the end of the year, T. Burrows, the p...

Questions

Physics, 29.11.2020 02:00

Mathematics, 29.11.2020 02:00

Mathematics, 29.11.2020 02:00

History, 29.11.2020 02:00

English, 29.11.2020 02:00