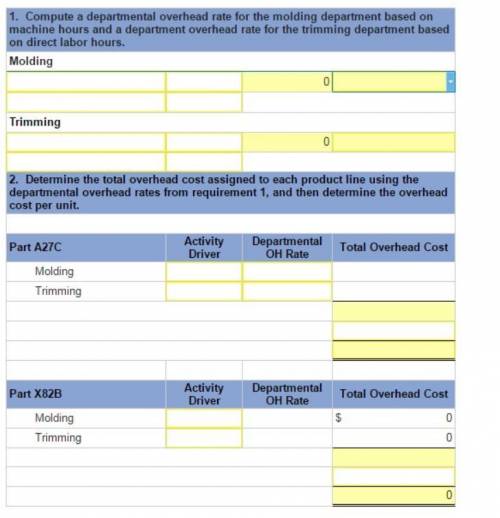

Textra Plastics produces parts for a variety of small machine manufacturers. Most products go through two operations, molding and trimming, before they are ready for packaging. Expected costs and activities for the molding department and for the trimming department for 2017 follow. (Round "OH rate and cost per unit" answers to 2 decimal places.)

Molding Trimming

Direct labor hours 52,000 DLH 48,000 DLH

Machine hours 30,500 MH 3,600 MH

Overhead costs $ 730,000 $ 590,000

Data for two special order parts to be manufactured by the company in 2017 follow:

Part A27C Part X82B

Number of units 9,800 units 54,500 units

Machine hours

Molding 5,100 MH 1,020 MH

Trimming 2,600 MH 650 MH

Direct labor hours

Molding 5,500 DLH 2,150 DLH

Trimming 700 DLH 3,500 DLH

Answers: 2

Another question on Business

Business, 21.06.2019 21:30

The balance sheet contains the following major sections: current assets long-term investments property, plant, and equipment intangible assets other assets current liabilities long-term liabilities contributed capital retained earnings accumulated other comprehensive income required: the following is a list of accounts. using the letters a through j, indicate in which section of the balance sheet each of the accounts would be classified. if an account does not belong under one of the sections listed, select "not under any of the choices" from the classification drop down box. for all accounts, indicate if the account is a contra account or an account that would normally be deducted on the balance sheet by selecting "yes" from the second drop down box, otherwise select "no". account classification contra or deducted (yes/no) 1. cash 2. bonds payable (due in 8 years) 3. machinery 4. deficit 5. unexpired insurance 6. franchise (net) 7. fund to retire preferred stock 8. current portion of mortgage payable 9. accumulated depreciation 10. copyrights 11. investment in held-to-maturity bonds 12. allowance for doubtful accounts 13. notes receivable (due in 3 years) 14. property taxes payable 15. deferred taxes payable 16. additional paid-in capital on preferred stock 17. premium on bonds payable (due in 8 years) 18. work in process 19. common stock, $1 par 20. land 21. treasury stock (at cost) 22. unrealized increase in value of available-for-sale securities

Answers: 3

Business, 22.06.2019 02:30

rural residential development company and suburban real estate corporation form a joint stock company. the longest duration a joint stock company can be formed for is

Answers: 2

Business, 22.06.2019 13:30

What do you recommend adam do to increase production in a business setting that does not seem to value high productivity?

Answers: 3

Business, 22.06.2019 20:30

Caleb construction (cc) incurs supervisor salaries expense in the construction of homes. if cc manufactures 100 homes in a year, fixed supervisor salaries will be $400,000. with the current construction supervisors, cc's productive capacity is 150 homes in a year. however, if cc is contracts to build more than 150 homes per year, it will need to hire additional supervisors, which are hired as full-time rather than temporary employees. cc's productive capacity would then become 200 homes per year, and salaries expense would increase to $470,000. how would cc’s salaries expense be properly classified? fixed variable mixed stepped curvilinear

Answers: 3

You know the right answer?

Textra Plastics produces parts for a variety of small machine manufacturers. Most products go throug...

Questions

Mathematics, 19.10.2019 04:50

History, 19.10.2019 04:50

Mathematics, 19.10.2019 04:50

History, 19.10.2019 04:50

Biology, 19.10.2019 04:50

English, 19.10.2019 04:50

Mathematics, 19.10.2019 04:50

Physics, 19.10.2019 04:50

Biology, 19.10.2019 04:50

Chemistry, 19.10.2019 04:50

History, 19.10.2019 04:50

Computers and Technology, 19.10.2019 04:50