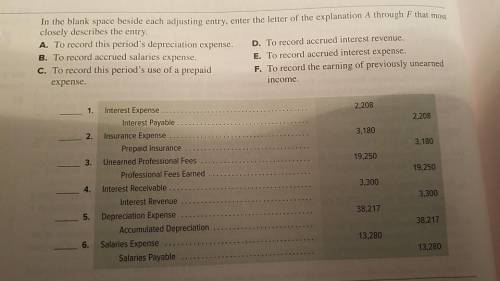

In the blank space beside each adjusting entry, enter the letter of the explanation A through Fthat most closely describes the entry

A To record this period's depreciation expense.

B. To record accrued salaries expense.

C. To record this period's use of a prepaid expense

D. To record accrued interest revenue

E. To record accrued interest expense.

F. To record the earning of previously unearned income.

Interest Expense 2,208

Interest Payable 2,208

Insurance Expense 3,180

Prepaid Insurance 3.180

Unearned Professional Fees19,250

Professional Fees Earned 19,250

Interest Receivable 3,300

Interest Revenue 3,300

Answers: 3

Another question on Business

Business, 22.06.2019 06:40

10. which of the following is true regarding preretirement inflation? a. defined-benefit plans provide more inflation protection than defined-contribution plans. b. because of preretirement inflation, possible investment-related growth is increased for defined-contribution plans. c. all types of benefits are designed to cope with preretirement inflation. d. preretirement inflation is generally reflected in the increase in an employee's compensation level over a working career.

Answers: 3

Business, 22.06.2019 11:00

Zoe would like to be able to save for night courses at the local college. which of these would be a good way for zoe to make more money available for savings without dramatically changing her budget? economía

Answers: 2

Business, 23.06.2019 02:30

Do you think it ethical and appropriate for marshall to have used himself as a test subject and swallowed a sample of helicobacter pylori? what precautions did he take? would you do it? why or why not?

Answers: 1

Business, 23.06.2019 10:20

George wants to collect funds to open his own bakery from his family. he needs an accurate estimate of how much money he would require to run the bakery for at least six months. he has to buy a shop (costing $3,500) and buy an oven (costing $600). his start-up costs, including various utility costs, would be $300. he has calculated his monthly expenses as $250. how much money would george require to start his business and run it for at least six months? a. $3500b. $5,900c. $7,200d. $7,400e. $8,200its not c.7200 tried it

Answers: 1

You know the right answer?

In the blank space beside each adjusting entry, enter the letter of the explanation A through Fthat...

Questions

History, 23.06.2019 18:30

English, 23.06.2019 18:30

Chemistry, 23.06.2019 18:30

Biology, 23.06.2019 18:30

Mathematics, 23.06.2019 18:30