Business, 14.06.2020 02:57 victoriay3

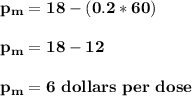

The biotech company Olderna has developed a new coronovirus vaccine it calls bug-b-gone or BBG. Unfortunately, it requires a fermentation process involving iguana eggs, making the marginal cost of the vaccine quite high. The cost function for doses of BBG is C(q) = 5,000 + 0.1q2 (where q is millions of doses). Demand for the vaccine in the US is projected to be D(p) = 90 - 5p, again in millions of doses. That means inverse demand, p(Q) = 18 - 0.2 Q. Part 1. Assume Oderna has a patent on the vaccine? How many (million) doses should it produce if it is maximizing profits from BBG? It should produce q = million doses. Part 2. What is the producer surplus of Olderna at the monopoly price and quantity? The PS will be million.

Answers: 2

Another question on Business

Business, 22.06.2019 00:50

cranium, inc., purchases term papers from an overseas supplier under a continuous review system. the average demand for a popular mode is 300 units a day with a standard deviation of 30 units a day. it costs $60 to process each order and there is a five−day lead−time. the holding cost for a paper is $0.25 per year and the company policy is to maintain a 98% service level. cranium operates 200 days per year.what is the reorder point r to satisfy a 98% cycleminus−service level? a. greater than 1,700 unitsb. greater than 1,600 units but less than or equal to 1,700 unitsc. greater than 1,500 units but less than or equal to 1,600 unitsd. less than or equal to 1,500 units

Answers: 1

Business, 22.06.2019 15:20

Record the journal entry for the provision for uncollectible accounts under each of the following independent assumptions: a. the allowance for doubtful accounts before adjustment has a credit balance of $500. b. the allowance for doubtful accounts before adjustment has a debit balance of $250. c. assume that octoberʼs credit sales were $70,000. uncollectible accounts expense is estimated at 2% of sales. smith, gaylord n.. excel applications for accounting principles (p. 51). cengage textbook. kindle edition.

Answers: 1

Business, 23.06.2019 17:30

Financial markets and channel to . they also channel money from individuals who want to for the future to those who need cash to spend today. a third function of financial markets is to allow individuals and businesses to adjust their risk. for example, , such as the vanguard index fund, and , such as spdr's or “spiders,” allow individuals to spread their risk across a large number of stocks. financial markets provide other mechanisms for sharing risks. for example, a wheat farmer and a baker may use the to reduce their exposure to wheat prices. financial markets and intermediaries allow investors to turn an investment into cash when needed. for example, the of public companies are because they are traded in huge volumes on the . are the main providers of payment services by offering checking accounts and electronic transfers. finally, financial markets provide information. for example, the of a company that is contemplating an issue of debt can look at the yields on existing to gauge how much interest the company will need to pay.

Answers: 3

Business, 23.06.2019 19:50

What are the real flows and money flows that run between households, firms, and governments in the circular flow model? the real flows are that flow from households to firms through markets. a. the services of factors of production; real b. payments; financial c. the services of factors of production; factor d. government goods; factor e. consumption goods; financial?

Answers: 1

You know the right answer?

The biotech company Olderna has developed a new coronovirus vaccine it calls bug-b-gone or BBG. Unfo...

Questions

Mathematics, 22.04.2021 18:10

Arts, 22.04.2021 18:10

History, 22.04.2021 18:10

Mathematics, 22.04.2021 18:10

Biology, 22.04.2021 18:10

Engineering, 22.04.2021 18:10

Mathematics, 22.04.2021 18:10

Mathematics, 22.04.2021 18:10