Business, 10.06.2020 02:57 tiatia032502

Bond A pays $8,000 in 20 years. Bond B pays $8,000 in 10 years. (To keep things simple, assume these are zero-coupon bonds, which means the $8,000 is the only payment the bondholder receives.)

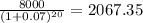

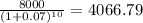

Suppose the interest rate is 7 percent.

Using the rule of 70, the value of Bond A is approximately , and the value of Bond B is approximately .

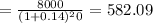

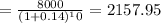

Now suppose the interest rate increases to 14 percent.

Using the rule of 70, the value of Bond A is now approximately , and the value of Bond B is approximately . Comparing each bond's value at 7 percent versus 14 percent, Bond A's value decreases by a percentage than Bond B's value. The value of a bond when the interest rate increases, and bonds with a longer time to maturity are sensitive to changes in the interest rate.

Answers: 2

Another question on Business

Business, 21.06.2019 16:30

What comprises a list of main points and sub-points of a topic to include in a presentation

Answers: 2

Business, 22.06.2019 05:30

Identify the three components of a family's culture and provide one example from your own experience

Answers: 2

Business, 22.06.2019 12:50

There is a small, family-owned store that sells food and household goods in a small town. the owners have good relations with the community, especially with local farmers who supply much of the food. the farmers aren't organized into a cooperative or union, and the store deals with each individually. suppose the store wanted to buy some farms to control the supply of certain vegetables. how would you classify this strategic move? select one: a. horizontal integration b. forward integration c. backward integration d. concentric integration

Answers: 2

Business, 22.06.2019 21:20

Which of the following best explains why large companies pay less for goods from wholesalers? a. large companies are able to pay for the goods they purchase in cash. b. large companies are able to increase the efficiency of wholesale production. c. large companies can buy all or most of a wholesaler's stock. d. large companies have better-paid employees who are better negotiators.

Answers: 2

You know the right answer?

Bond A pays $8,000 in 20 years. Bond B pays $8,000 in 10 years. (To keep things simple, assume these...

Questions

Chemistry, 04.07.2019 05:10

English, 04.07.2019 05:10

History, 04.07.2019 05:10

Mathematics, 04.07.2019 05:10

Mathematics, 04.07.2019 05:10

Mathematics, 04.07.2019 05:10

Computers and Technology, 04.07.2019 05:10

Business, 04.07.2019 05:10

Physics, 04.07.2019 05:10

Biology, 04.07.2019 05:10

History, 04.07.2019 05:10