Business, 29.05.2020 19:01 cleatcucarol

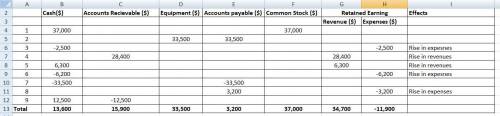

Sandhill Co. entered into these transactions during May 2022, its first month of operations.

1. Stockholders invested $37,000 in the business in exchange for common stock of the company.

2. Purchased computers for office use for $33,500 from Ladd on account.

3. Paid $2,500 cash for May rent on storage space.

4. Performed computer services worth $18,400 on account.

5. Performed computer services for Wharton Construction Company for $6,300 cash.

6. Paid Western States Power Co. $6,200 cash for energy usage in May.

7. Paid Ladd for the computers purchased in (2).

8. Incurred advertising expense for May of $3,200 on account.

9. Received $12,500 cash from customers for contracts billed in (4).

Using the following tabular analysis, show the effect of each transaction on the accounting equation. Put explanations for changes to revenues or expenses in the far right column. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced. See Illustration 3-4 for example.)

Answers: 3

Another question on Business

Business, 22.06.2019 04:30

Peyton taylor drew a map with scale 1 cm to 10 miles. on his map, the distance between silver city and golden canyon is 3.75 cm. what is the actual distance between silver city and golden canyon?

Answers: 3

Business, 22.06.2019 08:10

Exercise 15-7 crawford corporation incurred the following transactions. 1. purchased raw materials on account $53,000. 2. raw materials of $45,200 were requisitioned to the factory. an analysis of the materials requisition slips indicated that $9,400 was classified as indirect materials. 3. factory labor costs incurred were $65,400, of which $50,200 pertained to factory wages payable and $15,200 pertained to employer payroll taxes payable. 4. time tickets indicated that $55,000 was direct labor and $10,400 was indirect labor. 5. manufacturing overhead costs incurred on account were $81,700. 6. depreciation on the company’s office building was $8,100. 7. manufacturing overhead was applied at the rate of 160% of direct labor cost. 8. goods costing $89,400 were completed and transferred to finished goods. 9. finished goods costing $76,000 to manufacture were sold on account for $105,100. journalize the transactions. (credit account titles are automatically indented when amount is entered. do not indent manually.) no. account titles and explanation debit credit (1) (2) (3) (4) (5) (6) (7) (8) (9) (to record the sale) (to record the cost of the sale) click if you would like to show work for this question: open show work

Answers: 1

Business, 22.06.2019 09:00

How does the plaintiff, mrs. wood, try to implicate the gun manufacturer ( who testifies, what do they say, what evidence is introduced)?

Answers: 2

Business, 22.06.2019 19:40

Aprimary advantage of organizing economic activity within firms is thea. ability to coordinate highly complex tasks to allow for specialized division of labor. b. low administrative costs because of reduced bureaucracy. c. eradication of the principal-agent problem. d. high-powered incentive to work as salaried employees for an existing firm.

Answers: 1

You know the right answer?

Sandhill Co. entered into these transactions during May 2022, its first month of operations.

<...

<...

Questions

Mathematics, 20.08.2021 06:20

French, 20.08.2021 06:20

Mathematics, 20.08.2021 06:20

Mathematics, 20.08.2021 06:20

Mathematics, 20.08.2021 06:20

Advanced Placement (AP), 20.08.2021 06:20

Chemistry, 20.08.2021 06:20

Mathematics, 20.08.2021 06:20

English, 20.08.2021 06:20

Mathematics, 20.08.2021 06:20

English, 20.08.2021 06:20

Mathematics, 20.08.2021 06:20

Mathematics, 20.08.2021 06:20