Business, 28.05.2020 05:01 BreadOfTheBear

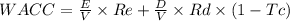

9) Marshall Corporation has established a target capital structure of 35 percent debt and 65 percent common equity. The current market price of the firm's stock is P0 = $28; its last dividend was D0 = $2.00, and its expected dividend growth rate is 5 percent constant. The YTM (Yield to Maturity) of Marshall’s outstanding bonds is 10%, and its marginal tax rate is 40%. Marshall can finance its equity portion with retained earnings. Find the weighted average cost of capital (WACC) of Marshall Corporation.

Answers: 2

Another question on Business

Business, 22.06.2019 04:00

Match the type of agreements to their descriptions. will trust living will prenuptial agreement

Answers: 2

Business, 22.06.2019 14:30

If a product goes up in price, and the demand for it drops, that product's demand is a. elastic b. inelastic c. stable d. fixed select the best answer from the choices provided

Answers: 1

Business, 22.06.2019 15:10

Paying attention to the purpose of her speech, which questions can she eliminate? a. 1 and 2 b. 3 c. 2 and 4 d. 1-4

Answers: 2

You know the right answer?

9) Marshall Corporation has established a target capital structure of 35 percent debt and 65 percent...

Questions

History, 31.12.2021 23:00

Mathematics, 31.12.2021 23:00

Health, 31.12.2021 23:00

History, 31.12.2021 23:10

Mathematics, 31.12.2021 23:10

Mathematics, 31.12.2021 23:10

Social Studies, 31.12.2021 23:10