Business, 24.05.2020 00:02 paigehixson9457

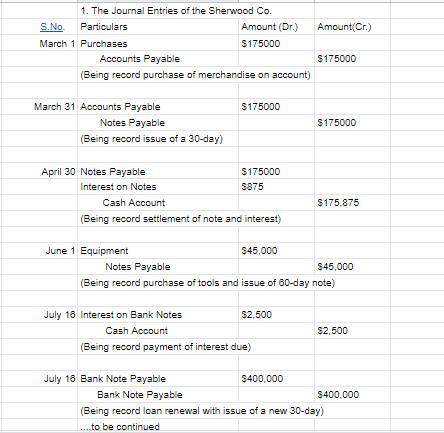

The following items were selected from among the transactions completed by Sherwood Co. during the current year:

Mar.

1 Purchased merchandise on account from Kirkwood Co., $175,000, terms n/30.

31 Issued a 30-day, 6% note for $175,000 to Kirkwood Co., on account.

Apr.

30 Paid Kirkwood Co. the amount owed on the note of March 31.

Jun.

1 Borrowed $400,000 from Triple Creek Bank, issuing a 45-day, 5% note.

Jul.

1 Purchased tools by issuing a $45,000, 60-day note to Poulin Co., which discounted the note at the rate of 7%.

16 Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 6% note for $400,000. (Journalize both the debit and credit to the notes payable account.)

Aug.

15 Paid Triple Creek Bank the amount due on the note of July 16.

30 Paid Poulin Co. the amount due on the note of July 1.

Dec.

1 Purchased equipment from Greenwood Co. for $260,000, paying $40,000 cash and issuing a series of ten 9% notes for $22,000 each, coming due at 30-day intervals.

22 Settled a product liability lawsuit with a customer for $50,000, payable in January. Accrued the loss in a litigation claims payable account.

31 Paid the amount due to Greenwood Co. on the first note in the series issued on December 1.

Required:1. Journalize the transactions. Refer to the Chart of Accounts for exact wording of account titles. Assume a 360-day year.2. Journalize the adjusting entry for each of the following accrued expenses at the end of the current year (refer to the Chart of Accounts for exact wording of account titles):a. Product warranty cost, $80,000.b. Interest on the nine remaining notes owed to Greenwood Co. Assume a 360-day year. help needed please

Answers: 1

Another question on Business

Business, 22.06.2019 01:30

If a firm plans to issue new stock, flotation costs (investment bankers' fees) should not be ignored. there are two approaches to use to account for flotation costs. the first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial investment cost. because the investment cost is increased, the project's expected return is reduced so it may not meet the firm's hurdle rate for acceptance of the project. the second approach involves adjusting the cost of common equity as follows: . the difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. quantitative problem: barton industries expects next year's annual dividend, d1, to be $1.90 and it expects dividends to grow at a constant rate g = 4.3%. the firm's current common stock price, p0, is $22.00. if it needs to issue new common stock, the firm will encounter a 6% flotation cost, f. assume that the cost of equity calculated without the flotation adjustment is 12% and the cost of old common equity is 11.5%. what is the flotation cost adjustment that must be added to its cost of retaine

Answers: 1

Business, 22.06.2019 20:30

What could cause a production possibilities curve to move down and to the left? a.) a nation loses land after being defeated in a war. b.) an increase in the use of computer technology speeds up production c.) a baby boom 20 years ago results in a large number of young adults in the population today. d.) thousands of investors from overseas invest money in a nations economy.

Answers: 1

Business, 22.06.2019 21:50

scenario: hawaii and south carolina are trading partners. hawaii has an absolute advantage in the production of both coffee and tea. the opportunity cost of producing 1 pound of tea in hawaii is 2 pounds of coffee, and the opportunity cost of producing 1 pound of tea in south carolina is 1/3 pound of coffee. which of the following statements is true? a. south carolina should specialize in the production of both tea and coffee. b. hawaii should specialize in the production of tea, whereas south carolina should specialize in the production of coffee. c. hawaii should specialize in the production of coffee, whereas south carolina should specialize in the production of tea. d. hawaii should specialize in the production of both tea and coffee.

Answers: 1

Business, 22.06.2019 22:50

Wendy made her career planning timeline in 2010. in what year should wendy's timeline start? a. 2013 o b. 2012 oc. 2010 o d. 2011

Answers: 2

You know the right answer?

The following items were selected from among the transactions completed by Sherwood Co. during the c...

Questions