Business, 19.05.2020 15:57 zanaplen27

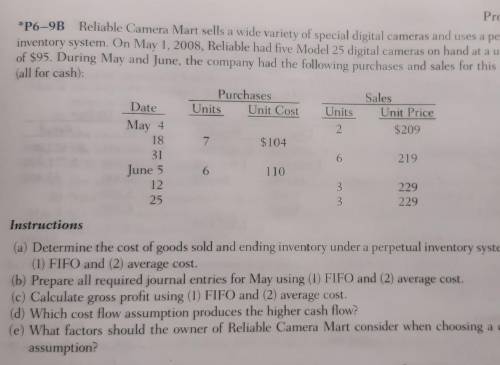

*P6-9B Reliable Camera Mart sells a wide variety of special digital cameras and uses a perpetual

inventory system. On May 1, 2008, Reliable had five Model 25 digital cameras on hand at a unit cost

of $95. During May and June, the company had the following purchases and sales for this camera (all for cash):

see image

Instructions

(a) Determine the cost of goods sold and ending inventory under a perpetual inventory system using

(1) FIFO and (2) average cost.

(b) Prepare all required journal entries for May using (1) FIFO and (2) average cost.

(c) Calculate gross profit using (1) FIFO and (2) average cost.

(d) Which cost flow assumption produces the higher cash flow?

(e) What factors should the owner of Reliable Camera Mart consider when choosing a cost flow

assumption?

Answers: 3

Another question on Business

Business, 22.06.2019 02:20

Each month, business today publishes a news piece about an innovative product, service, or business. such soft news is generally written by a freelance business writer and is known as a

Answers: 2

Business, 22.06.2019 23:50

Jaguar has full manufacturing costs of their s-type sedan of £22,803. they sell the s-type in the uk with a 20% margin for a price of £27,363. today these cars are available in the us for $55,000 which is the uk price multiplied by the current exchange rate of $2.01/£. jaguar has committed to keeping the us price at $55,000 for the next six months. if the uk pound appreciates against the usd to an exchange rate of $2.15/£, and jaguar has not hedged against currency changes, what is the amount the company will receive in pounds at the new exchange rate?

Answers: 1

Business, 23.06.2019 02:10

Make or buy eastside company incurs a total cost of $120,000 in producing 10,000 units of a component needed in the assembly of its major product. the component can be purchased from an outside supplier for $11 per unit. a related cost study indicates that the total cost of the component includes fixed costs equal to 50% of the variable costs involved. a. should eastside buy the component if it cannot otherwise use the released capacity? present your answer in the form of differential analysis. use negative sign represent a net disadvantage answer; otherwise do not use negative signs with your answers. cost from outside supplier $answer variable costs avoided by purchasing answer net advantage (disadvantage) to purchase alternative $answer b. what would be your answer to requirement (a) if the released capacity could be used in a project that would generate $50,000 of contribution margin? use negative sign represent a net disadvantage answer; otherwise do not use negative signs with your answers.

Answers: 2

Business, 23.06.2019 02:30

Zendor company wants to have $200,000 available in august 2021 to make an equipment purchase. to be able to have this amount available, zendor will make equal annual deposits in an investment account earning 12% annually in june 2017, 2018, 2019, 2020, and 2021. what is the dollar amount that must be deposited each of those years to achieve this objective?

Answers: 3

You know the right answer?

*P6-9B Reliable Camera Mart sells a wide variety of special digital cameras and uses a perpetual

Questions

Mathematics, 07.05.2021 02:50

Mathematics, 07.05.2021 02:50

Mathematics, 07.05.2021 02:50

Mathematics, 07.05.2021 02:50

Mathematics, 07.05.2021 02:50

Mathematics, 07.05.2021 02:50

Social Studies, 07.05.2021 02:50

Social Studies, 07.05.2021 02:50

Mathematics, 07.05.2021 02:50

Mathematics, 07.05.2021 02:50

Mathematics, 07.05.2021 02:50