Hedged Purchase Commitment and Exposed Liability Position, with Adjusting Entries

On November...

Business, 10.05.2020 07:57 beckytank6338

Hedged Purchase Commitment and Exposed Liability Position, with Adjusting Entries

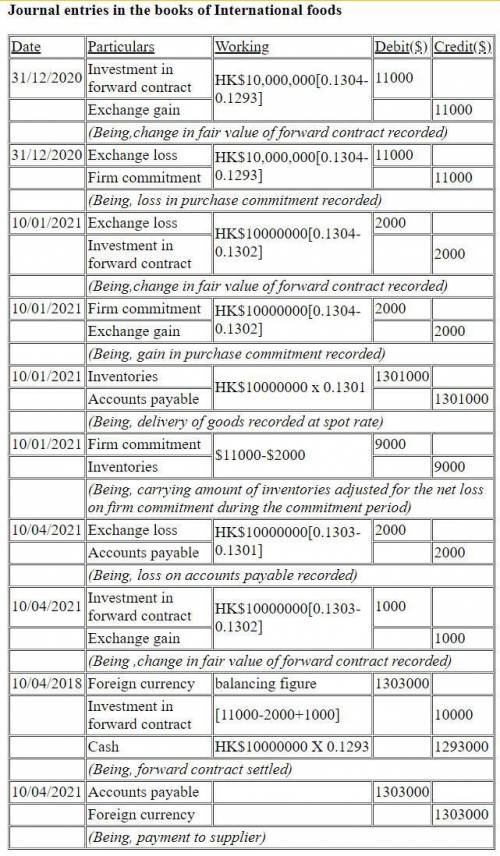

On November 20, 2020, International Foods, a U. S. company, agreed to purchase merchandise from a Hong Kong supplier at a price of HK$10,000,000. The merchandise will be delivered on January 10, 2021, and the amount owing is payable on April 10, 2021, in Hong Kong dollars. To hedge the expected future payment, International entered a forward contract for purchase of HK$10,000,000 on April 10, 2021. On January 10, 2021, the merchandise was delivered as promised. On April 10, International closed the forward contract and used the Hong Kong dollars to pay its supplier. International accounting year ends December 31. Exchange rates ($/HK$) are as follows:

Spot rate Forward rate for delivery April 10, 2021

November 20, 2020 $0.1289 $0.1293

December 31,2020 0.1299 0.1304

January 10,2021 0.1301 0.1302

April 10,2021 0.1303

Prepare the journal entries International Foods made on January 10,2021 and April 10.2021 to record the above transactions, as well as its end-of-year adjusting entries on December 31, 2020.

Answers: 3

Another question on Business

Business, 22.06.2019 05:50

Nichols inc. manufactures remote controls. currently the company uses a plantminuswide rate for allocating manufacturing overhead. the plant manager is considering switchingminusover to abc costing system and has asked the accounting department to identify the primary production activities and their cost drivers which are as follows: activities cost driver allocation rate material handling number of parts $5 per part assembly labor hours $20 per hour inspection time at inspection station $10 per minute the current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $20 per labor hour. what are the indirect manufacturing costs per remote control assuming an method is used and a batch of 10 remote controls are produced? the batch requires 100 parts, 5 direct manufacturing labor hours, and 3 minutes of inspection time.

Answers: 2

Business, 22.06.2019 08:40

Which of the following statements is true regarding the reporting of outside interests and the management of conflicts? investigators are responsible for developing their own management plans for significant financial interests. the institution must report identified financial conflicts of interest to the u.s. office of research integrity. investigators must disclose their significant financial interests related to their institutional responsibilities and not just those related to a particular project. investigators must disclose all of their financial interests regardless of whether they are related to a research project.

Answers: 3

Business, 22.06.2019 08:50

Suppose that in an economy the structural unemployment rate is 2.2 percent, the natural unemployment rate is 5.3 percent, and the cyclical unemployment rate is 2 percent. the frictional unemployment rate is percent and the actual unemployment rate (in this economy) is percent.

Answers: 2

Business, 22.06.2019 20:30

Mordica company identifies three activities in its manufacturing process: machine setups, machining, and inspections. estimated annual overhead cost for each activity is $156,960, $382,800, and $84,640, respectively. the cost driver for each activity and the expected annual usage are number of setups 2,180, machine hours 25,520, and number of inspections 1,840. compute the overhead rate for each activity. machine setups $ per setup machining $ per machine hour inspections $ per inspection

Answers: 1

You know the right answer?

Questions

Mathematics, 17.10.2019 13:50

Chemistry, 17.10.2019 13:50

Spanish, 17.10.2019 13:50

World Languages, 17.10.2019 13:50

Mathematics, 17.10.2019 13:50

Mathematics, 17.10.2019 13:50

Computers and Technology, 17.10.2019 13:50

Social Studies, 17.10.2019 13:50

History, 17.10.2019 13:50