Business, 06.05.2020 05:40 Bryson2148

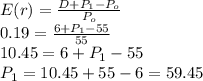

Problem 9-17 Assume that the risk-free rate of interest is 4% and the expected rate of return on the market is 14%. A share of stock sells for $55 today. It will pay a dividend of $6 per share at the end of the year. Its beta is 1.5. What do investors expect the stock to sell for at the end of the year? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Answers: 3

Another question on Business

Business, 22.06.2019 03:30

Tiana daniels enterprise’s trial balance as at december 31, 2016 did not balance. on february 15, 2017 the following errors were detected: errorsi. water rates had been undercast by $2, 000. ii. a cheque paid to yvonne walch of $2, 680 had been posted to the credit side of her account. iii. discount received total of $1, 260 had been posted to the debit side of the discount allowed account as $1, 620. iv. rent paid in the amount of $24, 000 had been posted to the credit of the rent received account. v. wayne returned goods valuing $1, 680 to daniels enterprise but had been completely omitted from the books. required: 1. prepare the journal entries to correct the errors. (narrations required) 14.5 marks 2. prepare the suspense account showing clearly the original trial balance error. 8 marks

Answers: 2

Business, 22.06.2019 09:20

Which statement best defines tuition? tuition is federal money awarded to a student. tuition is aid given to a student by an institution. tuition is money borrowed to pay for an education. tuition is the price of attending classes at a school.

Answers: 1

Business, 22.06.2019 19:30

At december 31, 2016, pina corporation had the following stock outstanding. 10% cumulative preferred stock, $100 par, 107,810 shares $10,781,000 common stock, $5 par, 4,026,000 shares 20,130,000 during 2017, pina did not issue any additional common stock. the following also occurred during 2017. income from continuing operations before taxes $21,950,000 discontinued operations (loss before taxes) $3,505,000 preferred dividends declared $1,078,100 common dividends declared $2,300,000 effective tax rate 35 % compute earnings per share data as it should appear in the 2017 income statement of pina corporation

Answers: 1

Business, 22.06.2019 20:00

What part of the rational model of decision-making does the former business executive “elliott” have a problem completing?

Answers: 2

You know the right answer?

Problem 9-17 Assume that the risk-free rate of interest is 4% and the expected rate of return on the...

Questions

Mathematics, 12.08.2020 09:01

Mathematics, 12.08.2020 09:01

English, 12.08.2020 09:01

Mathematics, 12.08.2020 09:01

Mathematics, 12.08.2020 09:01

Computers and Technology, 12.08.2020 09:01

Spanish, 12.08.2020 09:01

Mathematics, 12.08.2020 09:01

Mathematics, 12.08.2020 09:01

)= 4% = 0.04,

)= 4% = 0.04, = 14% = 0.14

= 14% = 0.14 ) = 1.5

) = 1.5 = $55

= $55 ) is given as:

) is given as:

) is given as:

) is given as: