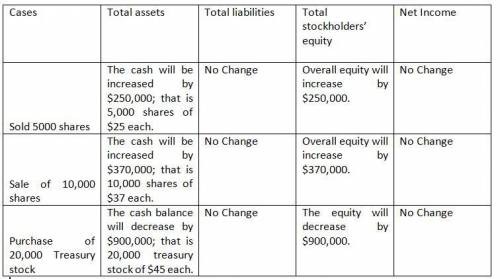

Trans Union Corporation issued 6,800 shares for $50 per share in the current year, and it issued 11,800 shares for $37 per share in the following year. The year after that, the company reacquired 21,800 shares of its own stock for $45 per share. Determine the impact (increase, decrease, or no change) of each of these transactions on the following classifications:1. Sold 5,000 Shares what is: A. Total Assets? B. Total Liabilities? C. Total Stockholders Equity? D. Net Income?2. Sold 10,000 Shares: what is: A. Total Assets? B. Total Liabilities? C. Total Stockholders Equity? D. Net Income?3. Purchased 20,0000 of Treasury Stocks: what is: A. Total Assets? B. Total Liabilities? C. Total Stockholders Equity? D. Net Income?

Answers: 2

Another question on Business

Business, 21.06.2019 16:00

Navel county choppers, inc., is experiencing rapid growth. the company expects dividends to grow at 19 percent per year for the next 8 years before leveling off at 5 percent into perpetuity. the required return on the company’s stock is 10 percent. if the dividend per share just paid was $1.52, what is the stock price?

Answers: 2

Business, 22.06.2019 05:50

Match the steps for conducting an informational interview with the tasks in each step.

Answers: 1

Business, 22.06.2019 08:10

The sec has historically raised questions regarding the independence of firms that derive a significant portion of their total revenues from one audit client or group of clients because the sec staff believes this situation causes cpa firms to

Answers: 3

You know the right answer?

Trans Union Corporation issued 6,800 shares for $50 per share in the current year, and it issued 11,...

Questions

Mathematics, 17.12.2021 01:00

Social Studies, 17.12.2021 01:00

Mathematics, 17.12.2021 01:00

Business, 17.12.2021 01:00

Mathematics, 17.12.2021 01:00

Mathematics, 17.12.2021 01:00