Business, 04.05.2020 23:56 hardwick744

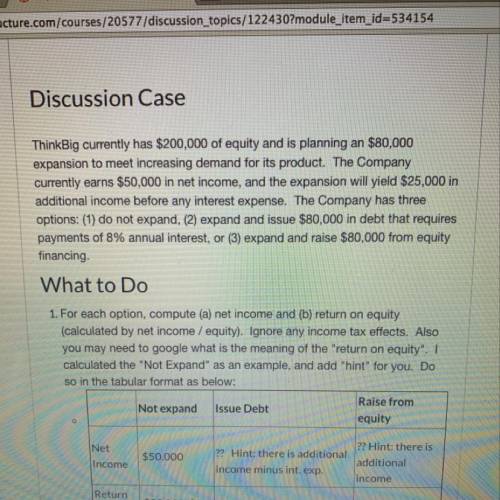

Thinkbig currently has $200000 of equity and is planning an $80000 expansion to meet increasing demand for its product. The company currently earns $50000 in net income, and the expansion will yield $25000 in additional income before any interest expense. The company has three options: 1) do not expand, 2) expand and issue $80000 from equity financing.

Answers: 2

Another question on Business

Business, 22.06.2019 09:00

Asap describe three different expenses associated with restaurants. choose one of these expenses, and discuss how a manager could handle this expense.

Answers: 1

Business, 22.06.2019 21:40

Penny poodle wanted to know which dog obedience training program was more effective: puppy pride, the approach she has been using for any years, or doggie do-right, a new approach. penny convinced 50 human companions of untrained dogs to participate in her study. the dogs and their humans were randomly assigned to complete the puppy pride or doggie do-right course. at the end of the training programs, all of the dogs were scored on their level of obedience on a standardized dog obedience checklist (scores could range from 10 to 100). the design of this study is:

Answers: 2

Business, 22.06.2019 23:40

When randy, a general manager of a national retailer, moved to a different store in his company that was having difficulty, he knew that sales were low and after talking to his employees, he found morale was also low. at first randy thought attitudes were poor due to low sales, but after working closely with employees, he realized that the poor attitudes were actually the cause of poor sales. randy was able to discover the cause of the problem by utilizing skills.

Answers: 2

Business, 23.06.2019 13:10

Barry owns a 50 percent interest in b& b interests, a partnership. his brother, benny, owns a 35 percent interest in that same partnership, and the remaining 15 percent is owned by an unrelated individual. during 2016, barry sells a rental property with a basis of $60,000 to b& b interests for $100,000. the partnership intends to hold the rental as inventory for resale. what is the amount and nature of barry’s gain or loss on this transaction?

Answers: 1

You know the right answer?

Thinkbig currently has $200000 of equity and is planning an $80000 expansion to meet increasing dema...

Questions

Mathematics, 07.12.2020 14:00

History, 07.12.2020 14:00

English, 07.12.2020 14:00

Law, 07.12.2020 14:00

English, 07.12.2020 14:00

Mathematics, 07.12.2020 14:00

Chemistry, 07.12.2020 14:00

English, 07.12.2020 14:00

Social Studies, 07.12.2020 14:00

Mathematics, 07.12.2020 14:00

English, 07.12.2020 14:00

Mathematics, 07.12.2020 14:00

Biology, 07.12.2020 14:00

English, 07.12.2020 14:00