Business, 06.05.2020 00:57 sweetiezylp8umho

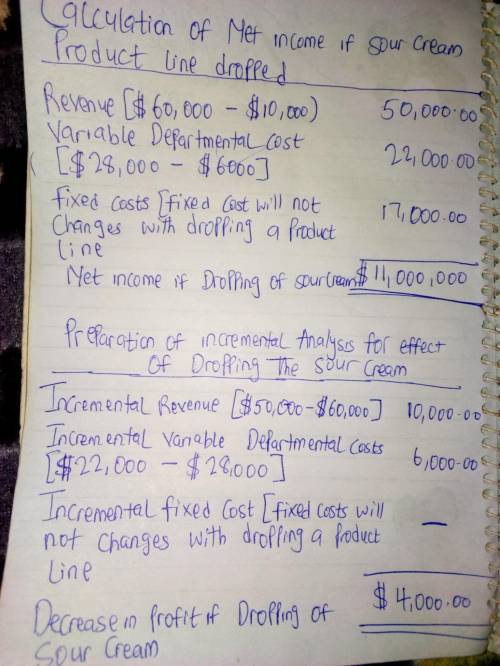

Keith Inc. has 4 product lines: sour cream, ice cream, yogurt, and butter. Demand of individual products is not affected by changes in other product lines. 30% of the fixed costs are direct, and the other 70% are allocated. Results of June follow:

Sour Cream Ice Cream Yogurt Butter Total

Units sold 2,000 500 400 200 3,100

Revenue $ 10,000 $ 20,000 $ 10,000 $ 20,000 $ 60,000

Variable departmental costs 6,000 13,000 4,200 4,800 28,000

Fixed costs 5,000 2,000 3,000 7,000 17,000

Net income (loss) $ (1,000) $ 5,000 $ 2,800 $ 8,200 $ 15,000

Required:

a. Prepare an incremental analysis of the effect of dropping the sour cream product line. (Enter negative amounts using either a negative sign preceding the number e. g. -45 or parentheses e. g. (45).

Answers: 3

Another question on Business

Business, 21.06.2019 19:20

Chester has a credit score of 595 according to the following table his credit rating is considered to be which of these

Answers: 1

Business, 22.06.2019 08:30

Blank is the internal operation that arranges information resources to support business performance and outcomes

Answers: 2

Business, 22.06.2019 11:30

Margaret company reported the following information for the current year: net sales $3,000,000 purchases $1,957,000 beginning inventory $245,000 ending inventory $115,000 cost of goods sold 65% of sales industry averages available are: inventory turnover 5.29 gross profit percentage 28% how do the inventory turnover and gross profit percentage for margaret company compare to the industry averages for the same ratios? (round inventory turnover to two decimal places. round gross profit percentage to the nearest percent.)

Answers: 2

Business, 22.06.2019 12:10

Lambert manufacturing has $100,000 to invest in either project a or project b. the following data are available on these projects (ignore income taxes.): project a project b cost of equipment needed now $100,000 $60,000 working capital investment needed now - $40,000 annual cash operating inflows $40,000 $35,000 salvage value of equipment in 6 years $10,000 - both projects will have a useful life of 6 years and the total cost approach to net present value analysis. at the end of 6 years, the working capital investment will be released for use elsewhere. lambert's required rate of return is 14%. the net present value of project b is:

Answers: 2

You know the right answer?

Keith Inc. has 4 product lines: sour cream, ice cream, yogurt, and butter. Demand of individual prod...

Questions

Biology, 27.06.2019 08:00

Health, 27.06.2019 08:00

Spanish, 27.06.2019 08:00

History, 27.06.2019 08:00

Mathematics, 27.06.2019 08:00

Mathematics, 27.06.2019 08:00

Mathematics, 27.06.2019 08:00

Advanced Placement (AP), 27.06.2019 08:00

Mathematics, 27.06.2019 08:00

History, 27.06.2019 08:00

Biology, 27.06.2019 08:00

Advanced Placement (AP), 27.06.2019 08:00

Mathematics, 27.06.2019 08:00